Tiara Wallace recently accepted her role as the Director of Risk for Invesco US and can’t seem to hide her contagious excitement for her profession. After announcing in a recent interview with Triple-I that she is a new “dog mom,” she proudly revealed that she is a parent to a 20-year-old “who is in college and recently switched his major to risk management.”

She had explained to her son how some activities in his current (but unrelated) campus job, such as “reviewing contracts and determining if the appeal process is working,” could be a good foundation for a future role in the field.

Wallace’s advocacy for careers in risk management doesn’t stop with her family. Having spent some time as an adjunct professor at the University of Oklahoma, she delights in frequently sharing with young people the benefits and opportunities they might find in her profession. She tells them that “insurance and risk management is such a great and lucrative career,” welcoming people from various backgrounds.

“Some folks have college, some people just have experience in the industry. But you’re able to make it into whatever you need for your life. And there’s so many routes you can go down.”

She launched her journey by working in claims adjustment for ten years. Then she decided it was time for a change. “Do I pivot now and make the change into something else?” she asked herself.

A friend remarked on her talent for educating people and understanding what drives claims. “Have you ever thought about safety or risk management?” her friend asked.

Wallace says a risk management major wasn’t available to her as an undergraduate. “So I did what any typical millennial does and I got on the Internet and started to look up jobs.”

She was surprised to discover she was already familiar with the foundations. She thought, “This is what we all do day-to-day, right – managing our decisions and determining where our risk appetite is?

She gives ample credit to her mentor, who has since become a family friend, for giving her a transformational opportunity. “He was the VP of Risk for a privately held bank in Oklahoma,” she says. He hired her as the risk manager for a family group of 20 ultra-high-net-worth individuals.

The job suited her well. “It was never mundane…and that really spoke to me and really started the journey into risk management for me.”

Years later, Wallace eventually relocated to Dallas and is now in her role working with commercial real estate and private equity at Invesco. The knowledge and skills she acquired working with the private firm are helping her excel in a publicly traded company, where she continues to grow.

“I’m learning a ton, and there’s a lot coming at me, but I enjoy the challenge.”

When asked what changes she’s witnessed in her field over the years regarding diversity, Wallace is candid, pragmatic, and hopeful.

“Going from a call center and claims where you see all types of people to these areas where it’s on the commercial side, and I’m going to different conferences. Sometimes, you can see the same type of person that fills the role.”

Wallace describes her firsthand account of an issue that is widely documented by various organizations – from the Bureau of Labor Statistics (BLS) to key players in the risk management field, such as Marsh.

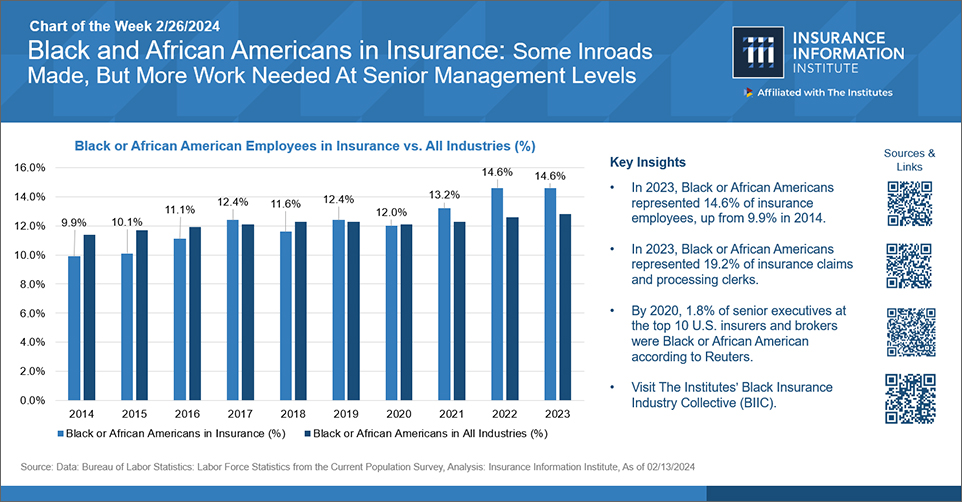

For example, BLS data on Black and African American representation in the insurance industry shows that representation is increasing, with 14.6% employees in the field, up from 9.9% in 2014. Black professionals held 19.2% of insurance claims and processing clerk roles. However, as of 2020, only 1.8% (just three out of 168) of executive employees in the industry are Black, according to data sourced by Reuters

“In the last three or four years, I think what I’ve began to see, just from the different generations entering in, is there is a more of a push for that diversity,” Wallace says. She notes that the diversity sought is not only in race, ethnicity, gender, and other identities but also in neurodiversity and professional backgrounds.

“I think that we still have a long way to go. But we’re starting to see more where the realization is, hey, we need a diverse candidate pool because here in the next what, 5 to 10 years, we’re gonna have an exodus in this market.”

Wallace admits that, as a long-standing industry, insurance can take some time to catch up while technology, demographics, and other structural factors are rapidly changing the game for the entire economy.

“We have not traditionally, and we’re still currently, not always quick to jump on thinking proactively or moving forward.” Nonetheless, Wallace says she is taking an active role in creating the future she wants to see.

“And so I think the thing that I started to realize is… I’m gonna be part of this change. So let me get involved in organizations.” Her educational experience likely played a role in this outlook.

She recalls how her college business fraternity leader asked her to “Go find three people that look like you. And three people that do not look or come from where you come from and recruit them.”

Wallace took up the challenge, of course. “That was one of the most phenomenal years because I got to learn so much. So I brought that mindset into this industry,” she says.

When Wallace was studying for her master’s degree years ago, a professor encouraged the class to be “agents of social change, like go in and be a disruptor.”

Now, when she advises people on connecting with diverse prospects, she asks whether they are searching beyond their personal networks and traditional spaces. “Are you going to HBCUs (Historically Black Colleges and Universities)? Are you going to different candidate pools? Are you going to rural cities and towns where maybe people have not historically gone into? Are you also talking to veterans?”

Wallace also recognizes that the work environment will be as critical to diversity success as recruiting tactics. For example, she asks, “Are our spaces friendly and inviting to those that maybe have disabilities?”

She encourages aspiring professionals to think beyond the cliche of an insurance job to see where they may fit. “Are you good at marketing? Because these insurance companies need marketing departments. Are you handy on the Internet? Oh, well, great. There’s a place in cyber or also IT (Information Technology) infrastructure.” The goal, she says, is “just having these conversations to get different people into this space…in the industry.”

“Some of you are gonna be strategic, too, you know, to implant yourselves in areas that traditionally have not allowed you to enter.”

Wallace says she would tell her younger self that being bolder and assertive in asking for what she needs will be crucial.

“As a woman, you better be able to sell yourself and brag on yourself and not and not take a step back and just assume that’s what everyone is doing. Make the ask because you can get paid for what it is. But you have to be bold enough — whether that’s a sale, whether that’s a salary, whether that’s you need staffing in your department, or you need help. Make the ask because you are the one that is in there working it day to day.”