Reinsurers experienced near-record returns in 2023, and continued to post strong results in the first quarter of 2024, with up to a 12% improvement in combined loss ratios, according to Gallagher Re’s 1st View report.

The report attributes these positive outcomes to several factors, including relatively benign natural catastrophe activity, adjustments in the reinsurance market, improved conditions in primary markets, and higher reinvestment rates. Improved results have created a more favorable market for reinsurance buyers, with sufficient capital available to meet increased demand, Gallagher Re observed.

“This more comfortable market for buyers has been underpinned by an increasing supply of capital to meet increased demand as reinsurers balance sheets have expanded on the back of strong 2023 and Q1 2024 results,” commented Gallagher Re CEO Tom Wakefield.

Non-life insurance-linked securities (ILS) capital reached a record level of $107 billion at the end of 2023 and continued to grow in the first half of 2024, driven by successful catastrophe bonds and increased investor interest.

However, ILS capacity became less abundant by midyear, as the Atlantic hurricane season approached, Gallagher Re noted.

“ILS capacity became scarce as ILS investors were ‘unnerved’ by forecasts of an active hurricane season,” the report stated.

Property outlook

The property reinsurance market has experienced increased competitiveness and capacity due to reinsurers’ strong performance in recent years, the report noted.

While reinsurers were not significantly impacted by natural catastrophe losses in Q1, there were an estimated $43 billion of economic losses and $20 billion insured losses in Q1 with both numbers being near the 10-year average.

The first quarter is not traditionally a major driver of the annual natural catastrophe loss burden, historically only representing 14% of the full-year total. Losses in Q1 have been dominated by severe convective storm losses (34% of insured losses) and other secondary perils of wildfire, drought and flood making up another 29%.

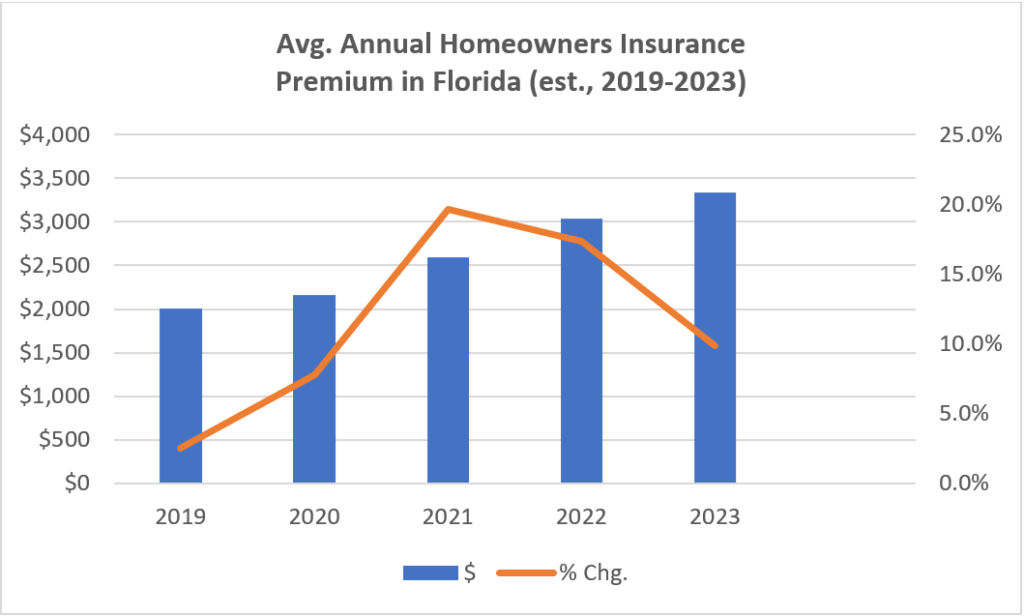

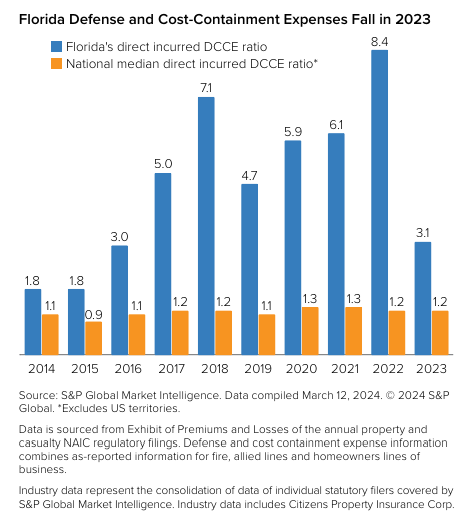

At July 1 renewals, risk-adjusted catastrophe pricing for Florida property was down 0% to 10% on average, and additional capacity demands of $3 billion to $5 billion in Florida were all met.

“Following three consecutive years of double-digit risk-adjusted rate increases, reinsurers were looking to hold the line from a procing perspective,” the reinsurance intermediary said of the Florida property catastrophe market.

The report also highlighted that buyers of property catastrophe insurance have been able to negotiate better terms and conditions on their reinsurance contracts due to the “risk on” approach taken by reinsurers. Risk-adjusted catastrophe placements in the U.S. generally were down 0% to 12% at July 1, Gallagher Re reported.

Non-catastrophe property pricing in the U.S. was down 0 to 10% for loss free accounts, but up 5% to 15% with losses.

Casualty outlook

“Casualty underwriters appear less confident than property underwriters outlined above, although this warrants its own caveat. The issues driving stakeholder concerns are regionally nuanced as the frequency and severity of casualty losses are driven by local societal, economic, judicial, legislative, and behavioral factors,” the report stated.

In the casualty insurance sector, concerns over rate adequacy in the U.S. have increased, following adverse development reported by liability insurers in the fourth quarter of 2023 and the first quarter of 2024. The lengthening and deteriorating tail of liability claims have exacerbated reinsurers’ concerns, as the market is already dealing with economic and non-economic loss inflation.

At July 1 renewals, risk adjusted excess of loss rates for U.S. general liability business were up 5% to 10% with no losses, and up 5% to 15% with emerging losses.

For U.S. health care liability, increased loss severity was seen across the health care sector. Excess of loss rates were up 0 to 5% for limited-exposed layers, and up 3% to 8% for catastrophe layers, without emerging losses. Rate increases were greater — up 5% to 20% — for layers with emerging losses.

Professional liability lines with no emerging losses saw excess of loss rates decline 0% to 5%, while accounts with losses experienced 0% to 10% increases.

Workers compensation has seen continued pressure for increases, even on loss-free layers, Gallagher Re noted. Excess of loss rates with no loss emergence were up 0 to 5% and with loss emergence, increased 5% to 10% at July 1.

The full report can be downloaded on the Gallagher Re website.