By Max Dorfman, Research Writer, Triple-I

This wildfire season is expected to be less intense than normal, but people in high-risk areas should be aware of and prepared for potential damage, according to Craig Clements, a professor of meteorology and climate science at San José State University.

“There are days people really need to be careful,” said Dr. Clements, who directs the Wildfire Interdisciplinary Research Center and is a Triple-I non-resident scholar. “High fire days are typically hot, dry, and windy. If there’s ignition, these fires can spread quickly, depending on the fuel type.”

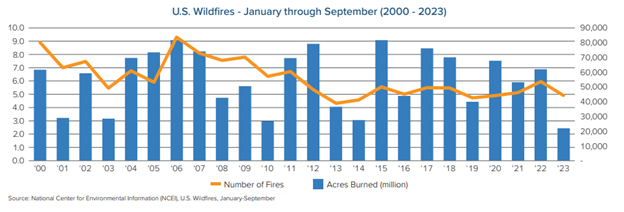

Despite record-breaking conflagrations across the Northern Hemisphere in recent years, U.S. wildfire frequency (number of fires) and severity (acres burned) have been declining in recent years and in 2023 were among the lowest in the past two decades.

While that trend is positive – reflecting progress in prevention of human-ignited wildfires – it isn’t a reason for complacency. Another long-term trend has been the doubling of the share of natural catastrophe insured losses from wildfires over the past 30 years, according to Swiss Re. This reflects the impact of a growing number of people living in the wildland-urban interface – the zone of transition between unoccupied and developed land, where structures and human activity intermingle with wildland and vegetative fuels.

A 2022 study in the journal Frontiers in Human Dynamics found that people are moving to areas that are increasingly vulnerable to catastrophic wildfires.

“They’re attracted by maybe a beautiful, forested mountain landscape and lower housing costs somewhere in the wildland-urban interface,” said University of Vermont environmental scientist Mahalia Clark, the paper’s lead author. “But they’re just totally unaware that wildfire is something they should even think about.”

To prepare, people should keep an eye out on the National Weather Service, social media, or watch the news, to ensure they are ready for any potential risks, and be on the lookout for Red Flag Warning days.

Dr. Clements also recommends referring to the National Interagency Fire Center website, which is updated daily for fire risks in particular regions. Triple-I suggests looking into the Wildfire Prepared Home designation program, which helps homeowners take protective measures for their home and yard to mitigate wildfire risks.

It’s also important for homeowners to remember that, following wildfires, rains can result in landslides and debris flows that often are not covered by insurance policies. It’s especially important to understand the difference between “mudslides” and “mudflow” and to discuss your coverage with an insurance professional.

Learn more:

2024 Wildfires Expected to Be Up From Last Year, But Still Below Average

Tamping Down Wildfire Threats: How Insurers Can Mitigate Risks and Losses

Mudslides Often Follow Wildfire; Prepare, Know Insurance Implications

Triple-I “State of the Risk” Issues Brief: Wildfires: State of the Risk