By Lewis Nibbelin, Contributing Writer, Triple-I

Recent efforts to curb federal spending – particularly massive proposed cuts to several major federal science agencies and numerous FEMA grant programs – drew concern from panelists at Triple-I’s Joint Industry Forum in Chicago.

Slated to lose around half of their original budgets, organizations like the National Oceanic and Atmospheric Administration (NOAA) and the National Science Foundation (NSF) provide insurers with much of the research data needed to model climate risks, at no cost to insurers nor the broader public. Abolishing this research, which also enables daily weather and natural disaster forecasting, will increase underwriting costs and those associated with various other industries, including transportation, agriculture, and energy.

“Federal science agencies probably facilitate more economic activity in the country than any other federal agency,” said Frank Nutter, president of the Reinsurance Association of America (RAA). “Fully funding and restaffing those agencies is pretty critical.”

A host of cancelled FEMA mitigation programs have left dozens of catastrophe-prone communities without aid – including projects that were approved before the cuts. Ending the Building Resilient Infrastructure and Communities (BRIC) program, for instance, rescinded approximately $882 million in climate resilience funding — “money we could have spent on mitigation, so we don’t have to spend so much after a disaster,” said Neil Alldredge, president and CEO of the National Association of Mutual Insurance Companies (NAMIC).

Nutter added that “weighing against safety, teacher salaries – all the kinds of things that communities grapple with,” most former grantees lack the resources for “risk reduction or municipal projects and infrastructure” without federal investment.

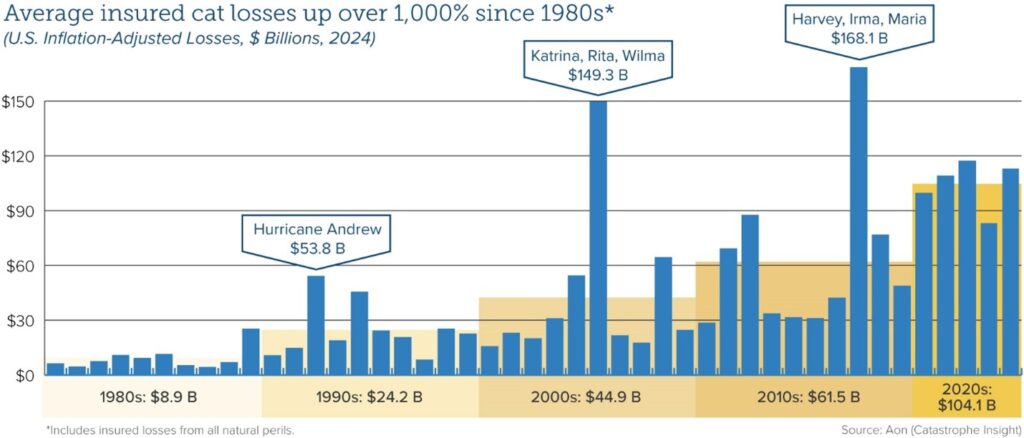

Population growth in high-risk areas exacerbates the issue, Alldredge said.

“If you look at a map of this country and the population changes from 1980 to today, we have moved the entire population to all the wrong places,” he explained. Building properties capable of withstanding these weather patterns – let alone insuring them – has launched the industry into “a new era of risk.”

While the panelists agreed that opportunities to improve FEMA operations exist, they questioned President Trump’s consideration to disband it entirely by shifting to a state-based relief system.

David Sampson, president and CEO of the American Property Casualty Insurance Association (APCIA), noted that “the very nature of a natural disaster means that it overwhelms the local entity’s ability to respond,” rendering any state-based solution “unworkable.”

“I think we as an industry know where the low-hanging fruit for reforms are,” Sampson continued, because “we interact with FEMA on the ground after disasters.”

State-level legislative momentum

Though the Trump administration’s current plans do not bode well for the future of disaster resilience, insurers celebrated many state legislative wins this year regarding tort reform, notably in Georgia and Louisiana.

“Even at the federal level, there is a growing sense of awareness of the negative impact that an out-of-control tort system is taking on the economy and the American consumer,” Sampson said, highlighting a new bill that would impose taxes on third-party litigation funding.

Florida also successfully resisted challenges to its 2023 and 2024 reforms, which have already helped stabilize the state’s insurance rates and attracted new insurers after a multi-year exodus. Charles Symington, president and CEO of the Independent Insurance Agents & Brokers of America, pointed out that industry advocacy is crucial to tort reform survival.

“Once you get these beneficial pieces of legislation passed,” he said, “we have to fight the fight in every legislative session.”

Symington then contrasted Florida’s recovering market with California’s enduringly hostile regulatory environment, propelled by the 1988 measure Proposition 103.

Insurance Commissioner Ricardo Lara has implemented a Sustainable Insurance Strategy to mitigate the effects of Prop 103 – such as by authorizing insurers to use catastrophe modeling if they agree to offer coverage in wildfire-prone areas – but the strategy has garnered criticism from legislators and consumer groups.

“California doesn’t have the assessment ability like Florida does,” agreed moderator Fred Karlinsky, shareholder and global chair of Greenberg Traurig, LLP. “California is three decades behind.”

As insurers adjust their risk appetite to reflect these constraints, more property owners have been pushed into California’s FAIR Plan – the state’s property insurer of last resort.

“Our members are having to cobble together coverage,” said Joel Wood, president and CEO of the Council of Insurance Agents & Brokers (CIAB), who noted that the FAIR plan’s policyholder count has more than doubled since 2020.

Natural disasters like January’s devastating wildfires underscore California’s need for premium rates that adequately reflect the full impact of these risks, which is essential to the continued availability of private insurance in the state.

“When you have the right leadership in place – the governor, the state legislature – and you have the industry being effective in our advocacy, then we can improve these difficult marketplaces,” Symington concluded.

Learn More:

JIF 2025: U.S. Policy Changes and Uncertainty Imperil Insurance Affordability

JIF 2025: Litigation Trends, Artificial Intelligence Take Center Stage

Insurance Affordability, Availability Demand Collaboration, Innovation

Tariff Uncertainty May Strain Insurance Markets, Challenge Affordability

Reining in Third-Party Litigation Funding Gains Traction Nationwide