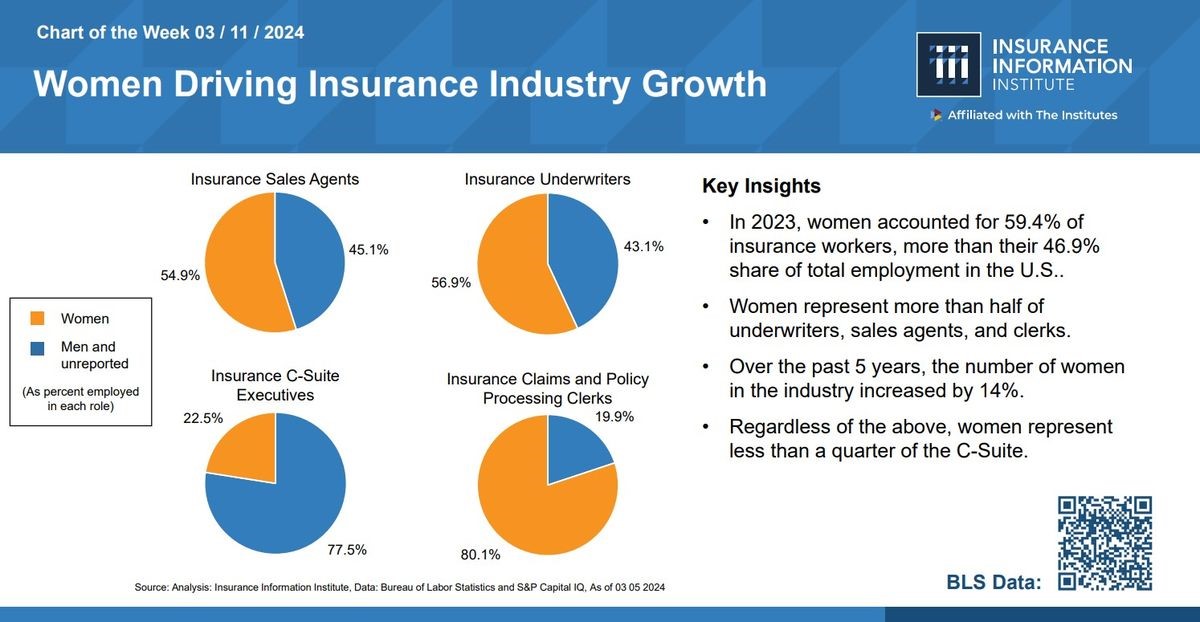

The insurance industry is on track for continued growth, with women playing a huge part, but gender equity at the top remains a long way off. Bureau of Labor Statistics (BLS) data shows the talent pipeline isn’t an issue, as women account for 59.4 percent of the insurance workforce. They comprise 80.1 percent of workers serving as claims and policy processing clerks, 54.9 percent in sales roles, and 56.9 percent of underwriters. Yet, only about 22 percent (less than 1 in 4) of workers in the C-Suite are women.

Despite the setbacks of the early pandemic years, in which women shouldered the brunt of related workforce losses, women have made up roughly 60 percent of the insurance workforce each year since 2012, exceeding their share of total employment in the U.S. (46.9 percent).

Private sector research adds more details to this stark picture. A Marsh study conducted in 2022 revealed that “25 out of 27 (92.5 percent) of the largest insurance companies were led by men.” Similarly, a McKinsey study showed, “white women make up 45 percent of entry-level roles yet…fewer than one in five direct reports to the CEO are women.” Gender disparities also appear to increase across race and ethnicity.

A recent study from Liberty Mutual and Safeco Insurance shows that the number of women owners or principals in insurance agencies decreased from 31 percent to 26 percent between 2022 and 2023. In contrast, women comprise 75 percent of customer-facing staff in those organizations.

S&P Global Research analysis findings suggest “women could reach parity in senior leadership positions between 2030 and 2037, among companies in the Russell 3000.” Whether that might play out sooner or later for insurance isn’t clear. The August 2023 report also reveals that the “majority of progress towards gender parity is coming from women taking seats on company boards.” Still, C-suite leadership across all industries may not show full gender parity until the 2050s, and “the highest levels in CEO and CFO positions could take even longer.”

Gender parity can offer solutions for a healthy financial future

Meanwhile, the industry expects to face massive attrition as thousands of workers (along with their leadership skills and knowledge) eventually exit the workforce in the coming years. Automation and artificial intelligence/machine learning (AI/ML) may eliminate the need for some roles. Still, insurers will undoubtedly need to maintain an ecosystem of efficiency and innovation to remain profitable. Increased implementation of data-driven processes and decision-making brings new ethical implications and regulatory responsibilities.

Organizational diversity is commonly defined as people from a variety of backgrounds and perspectives working together to solve business problems. Strategic long-term success requires identifying, developing, and promoting diverse talent at all levels. However, a lack of diversity at the C-suite level can undermine the most valiant recruitment efforts in other parts of the organization. Today’s driven and career-focused candidates are wary of glass ceilings and may want evidence that inclusion and equity come from the top.

Research has indicated women in leadership can positively impact the organizations they run. After a series of four studies over several years, findings from McKinsey indicate that “leadership diversity is also convincingly associated with holistic growth ambitions, greater social impact, and more satisfied workforces.” Further, the most recent study also notes the “business case for gender diversity on executive teams has more than doubled over the past decade.” Other research indicates that, among U.S. property-casualty insurance companies, female CEOs are associated with “lower insurer insolvency propensity, higher z-score, and lower standard deviation of return on assets.”

In the era of the nation’s first female vice-president, ultimately, corporate boards might find that reflecting the market demographics the savviest and most compelling of all reasons to diversify senior leadership. Together, U.S. millennials and the oldest Gen Zers (already taking on adult responsibilities) command nearly $3 trillion in spending power each year. Both generations have duly prepared themselves to advance in the workforce, becoming more educated than previous generations. And they will no doubt grab an opportunity where they can find it.