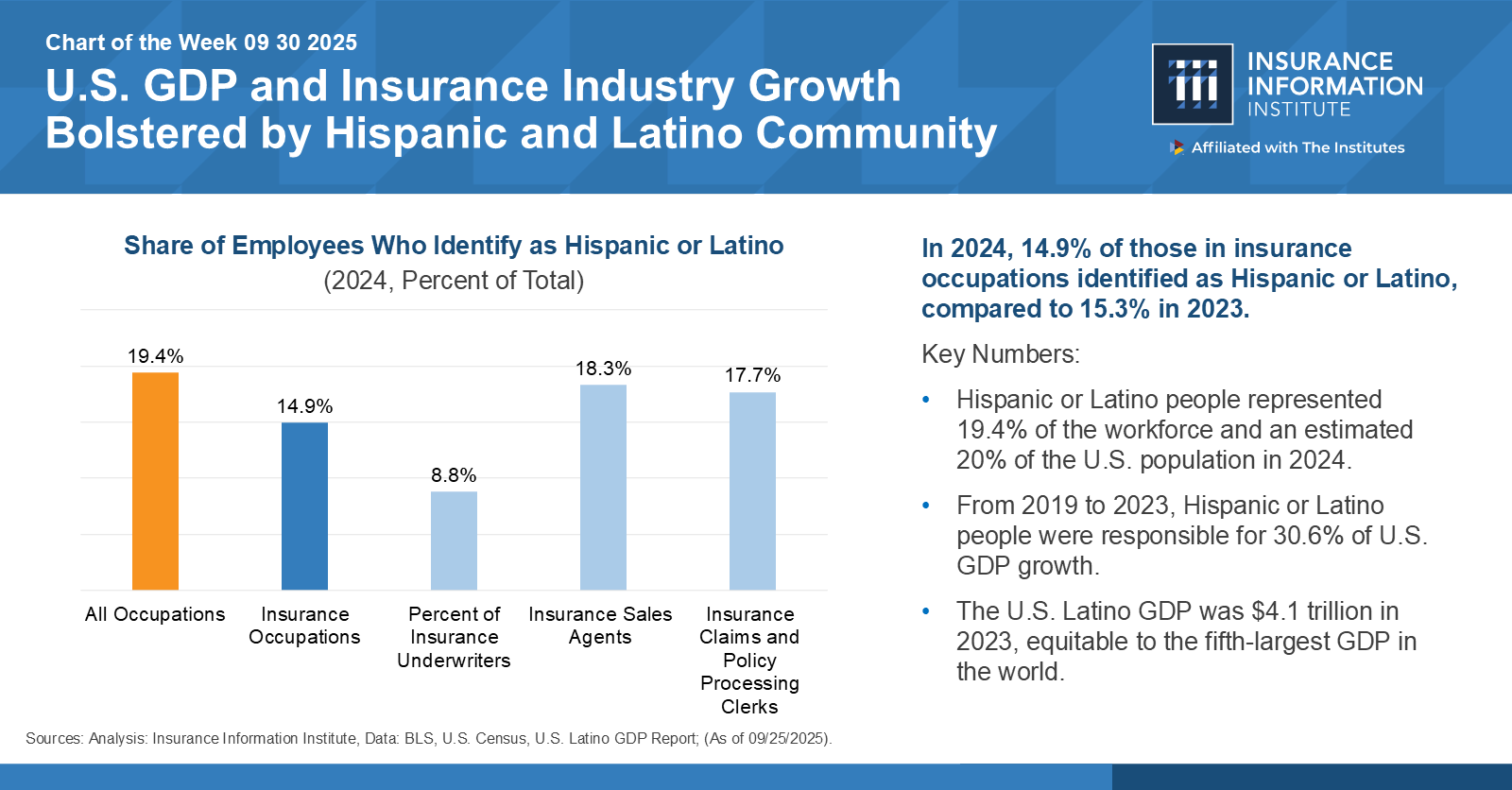

Even as Latinos continue to play an essential role in the U.S. economy, Latino representation of insurance industry workers fell slightly in 2024, to 14.9 percent, from 15.3 percent in 2023, according to a recent Triple-I “Chart of the Week”. The highest representation of this demographic was 18.3 percent of insurance sales agents, with claims and policy processing clerks following closely, at 17.7 percent. The lowest representation was among underwriters, at 8.8 percent.

The chart — “U.S. GDP and Insurance Industry Growth Bolstered by Hispanic and Latino Community.” — is based on data from the Bureau of Labor Statistics and the U.S. Latino GDP report.

From 2019 to 2023, Latinos drove 30.6 percent of U.S. GDP growth despite making up only about 20 percent of the overall U.S. population (by 2024) and 19.4 percent of the workforce. Latinos generate a GDP of $4.1 trillion by 2023 (up from $3.7 trillion in 2022), sufficient to rank alone as the fifth-largest GDP in the world. The Latino consumer market, with $2.7 trillion in consumption in 2023, has a buying power larger than the economies of powerhouse states such as Texas ($2.58 trillion) and New York ($2.17 trillion).

The National Association of Hispanic Real Estate Professionals predicts that Latinos will be the largest group of homebuyers in the country by 2030. Homeownership for this group is 9.8 million households, with 238,000 new Latino owner households added in 2023 alone —the largest increase of any racial or ethnic group for the second consecutive year. Data analysis indicates there may be more than 30 million new Latino drivers hitting the roads through 2050. Latinos are also the fastest-growing group of entrepreneurs, according to the Stanford Latino Entrepreneurship Initiative.

Effectively engaging this formidable market creates immense opportunity for the insurance industry. However, only just over half of the respondents to a survey conducted by Marsh and the Latin American Association of Insurance Agencies (LAAIA) said they believed their companies were invested in attracting Hispanic customers. Nearly two-thirds of respondents said insurers do not employ enough Latinos. Only 14 percent thought insurers employed an adequate number. Moreover, 84 percent agreed that Latinos are underrepresented in the senior management of most insurance companies.

Efforts to create a diverse and inclusive workforce can drive greater client satisfaction and loyalty. As Amy Cole-Smith, Executive Director for BIIC/ Director of Diversity at The Institutes, has pointed out, “this isn’t just about equity —it’s about unlocking growth and staying competitive in a changing market. When the insurance workforce reflects the diversity of the market, we’re in a stronger position to build products that meet people where they are.”