By Tasha Williams and Loretta Worters

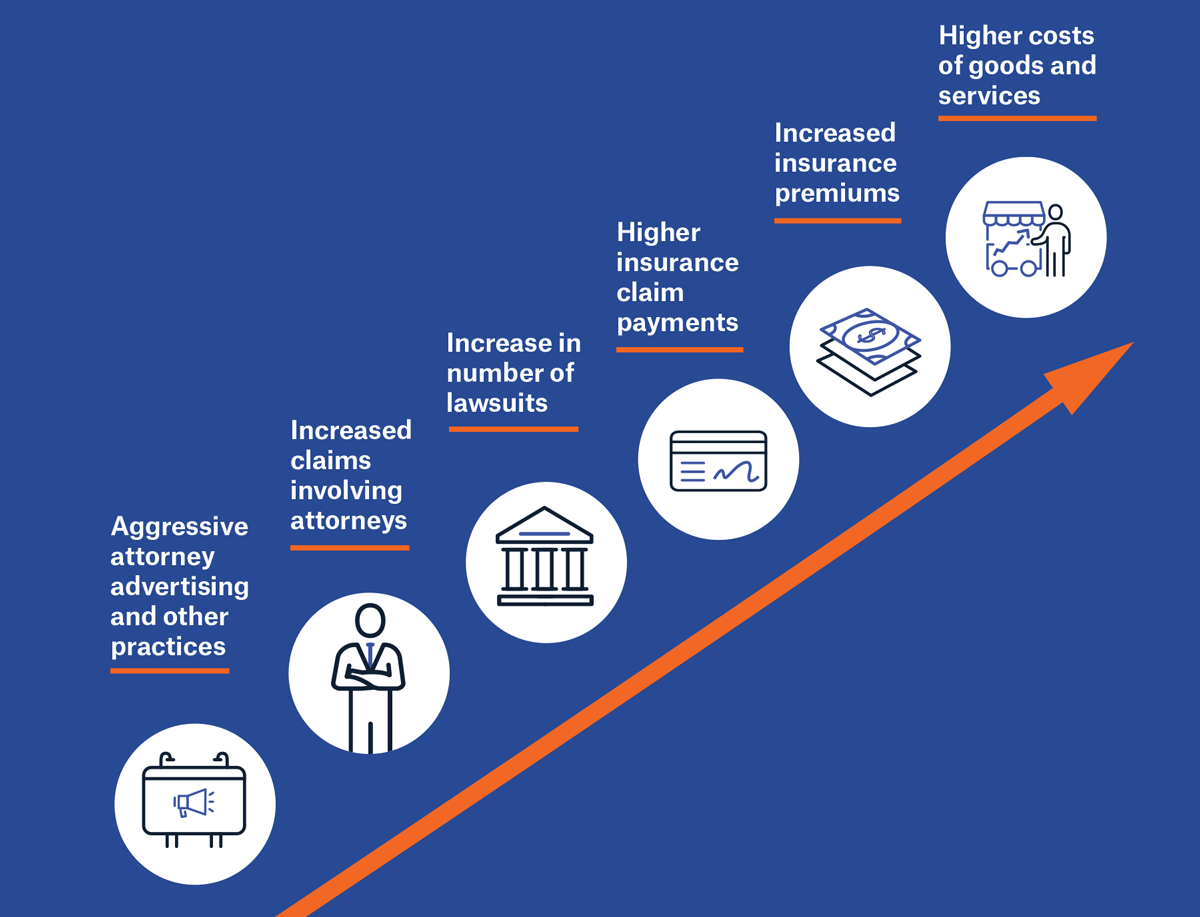

Practices that foster unnecessary or drawn-out litigation are among several hard-to-measure forces that can shift loss ratios for insurers and disrupt forecasts, making cost management more challenging. Ultimately, the resulting cost increase is passed on to consumers, which adversely impacts the affordability and availability of coverage. The Insurance Information Institute (Triple-I) and Munich Re US published a new resource to help consumers understand how legal system abuse is fueling higher claim costs, driving up premiums, and reducing the efficiency of our civil justice system.

A Consumer Guide: How Legal System Abuse Impacts You explains, using accessible language and engaging graphics, how elements of legal system abuse – including third-party litigation financing, persuasive jury anchoring, and the deluge of attorney advertising – can distort outcomes and siphon value away from injured parties, policyholders, and the economy.

“Legal system abuse has driven up litigation expenses and costs, impacting businesses and consumers across the United States,” said Joshua Hackett, Head of Casualty at Munich Re US. “If left unchecked, these rising costs will continue to increase insurance premiums and limit coverage options.”

The consumer guide outlines legal trends and quantifies the impact of legal system abuse beyond rising premiums.

• $6,664 in added annual costs for the average American family of four

• 4.8 million U.S. jobs lost due to excessive litigation

• $160 billion in tort-related costs borne by small businesses annually

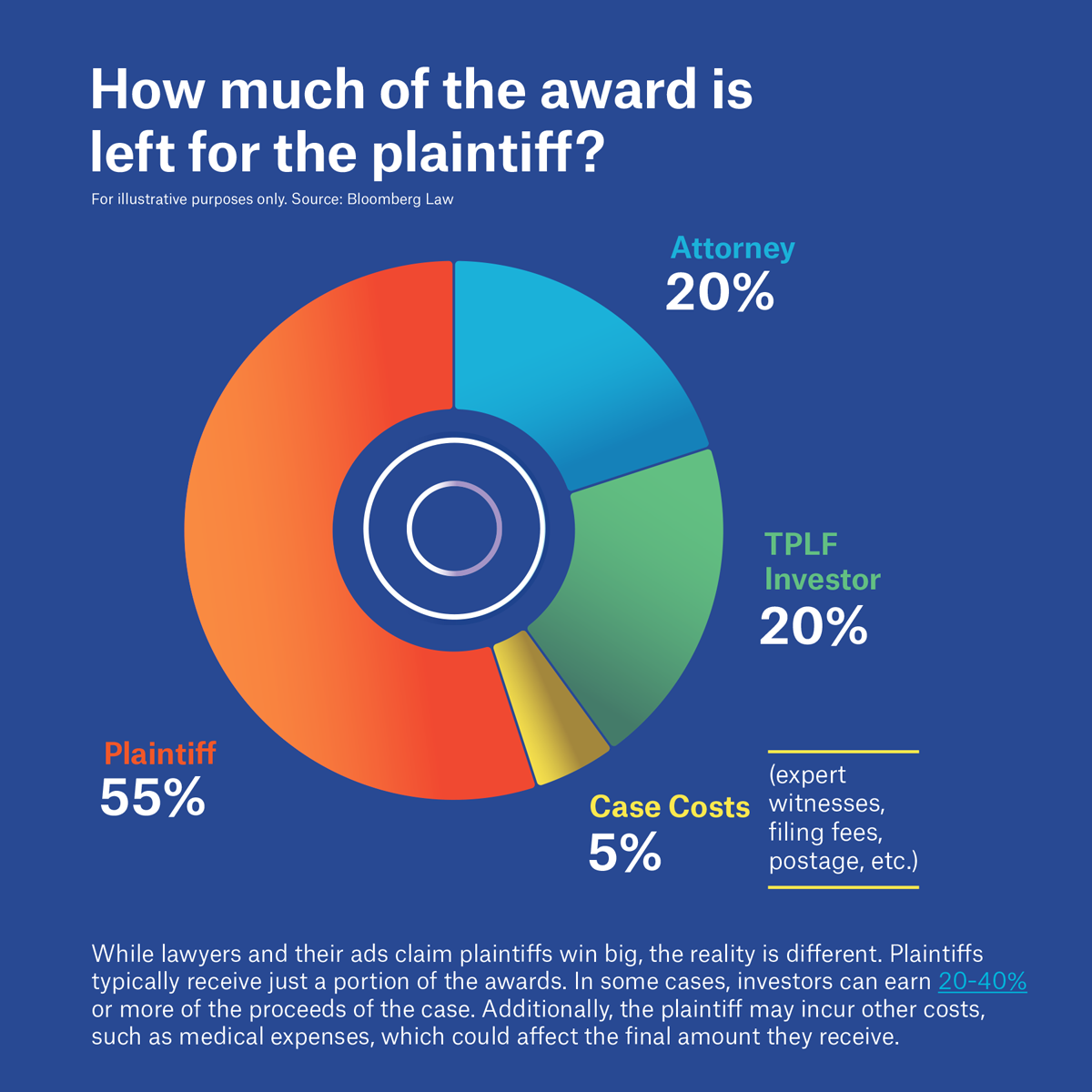

Who Benefits from Large Settlements?

The narrative of legal system abuse can be muddled by news of large, high-profile settlements, which can imply plaintiffs are winning big. In reality, injured parties typically end up with only a fraction of their awarded damages after fees, obligations to third-party litigation funders, and inflated expenses are taken into account.

According to a recent report from Duane Morris Class Action Review, a defense attorney interest group, $42 billion in class action settlements was reached last year, the third-highest value the group has tallied over the past twenty years. That figure included ten settlements of at least $1 billion. Products Liability Class Actions reaped by far the largest amount for a practice area, at $23.40 billion. Annual numbers for overall settlements reported in 2023 and 2022 were $51.4 billion and $60 billion, respectively.

However, the bulk of these settlements do not ultimately benefit the injured parties. Attorneys can charge contingency fees ranging from 33 to 40 percent for their labor, plus expenses incurred through litigation, such as court costs and expert witness fees. Additionally, the process for injured parties to claim and receive their share of the settlement can be complex and drawn out, and, often, it is not worth the small share amounts dispersed to most claimants in the long run. A 2019 Federal Trade Commission study estimates the median claims rate for consumer class action settlements was 9 percent and that the weighted mean — weighted by the size of the class — was only 4 percent.

“While billboard attorneys use exploitative advertisements promising big dollar settlements, the truth is consumers and business owners can be left with less money, sometimes substantially less, if third-party litigation financiers are involved,” said Triple-I CEO Sean Kevelighan.

The consumer guide reinforces what many risk and claims professionals are observing in the market.

- Longer case durations

- Higher settlements and awards

- Diminishing predictability in the legal environment

This erosion of predictability poses underwriting challenges and affects the affordability and availability of coverage, particularly in casualty and liability lines.

Legal system abuse can be mitigated by supporting public awareness and robust tort reform policy.

Triple-I and Munich Re US are encouraging the industry to advocate for:

- Disclosure requirements for litigation financing

- Reforms to reduce medical billing abuse

- More oversight of attorney advertising practices

The guide serves as an educational tool that insurers, brokers, and industry partners can share with clients and stakeholders to explain the link between premium increases, other rising costs, and potential legal exposure.

This collaboration between Triple-I and Munich Re US is part of Triple-I’s multi-faceted awareness campaign to help educate industry insiders, consumers, and other stakeholders about the challenges posed by legal system abuse to coverage affordability and availability. We invite you to learn more about legal system abuse by reading our issue briefs, such as “Legal System Abuse: State of the Risk” and “Legal System Abuse and Attorney Advertising for Mass Litigation: State of the Risk,” and visiting our knowledge hub on this topic. To join the discussion, register for JIF 2025.