While the insurance workforce has become incrementally more diverse, Black professionals remain starkly underrepresented in C-suites and senior leadership.

The Black Insurance Industry Collective (BIIC) recently released a report, Fostering Black Leadership in Insurance, which calls attention to this industry-wide leadership gap.

The report explains how organizations can take strategic, data-driven actions to identify and overcome the structural barriers limiting the advancement of Black professionals in the industry.

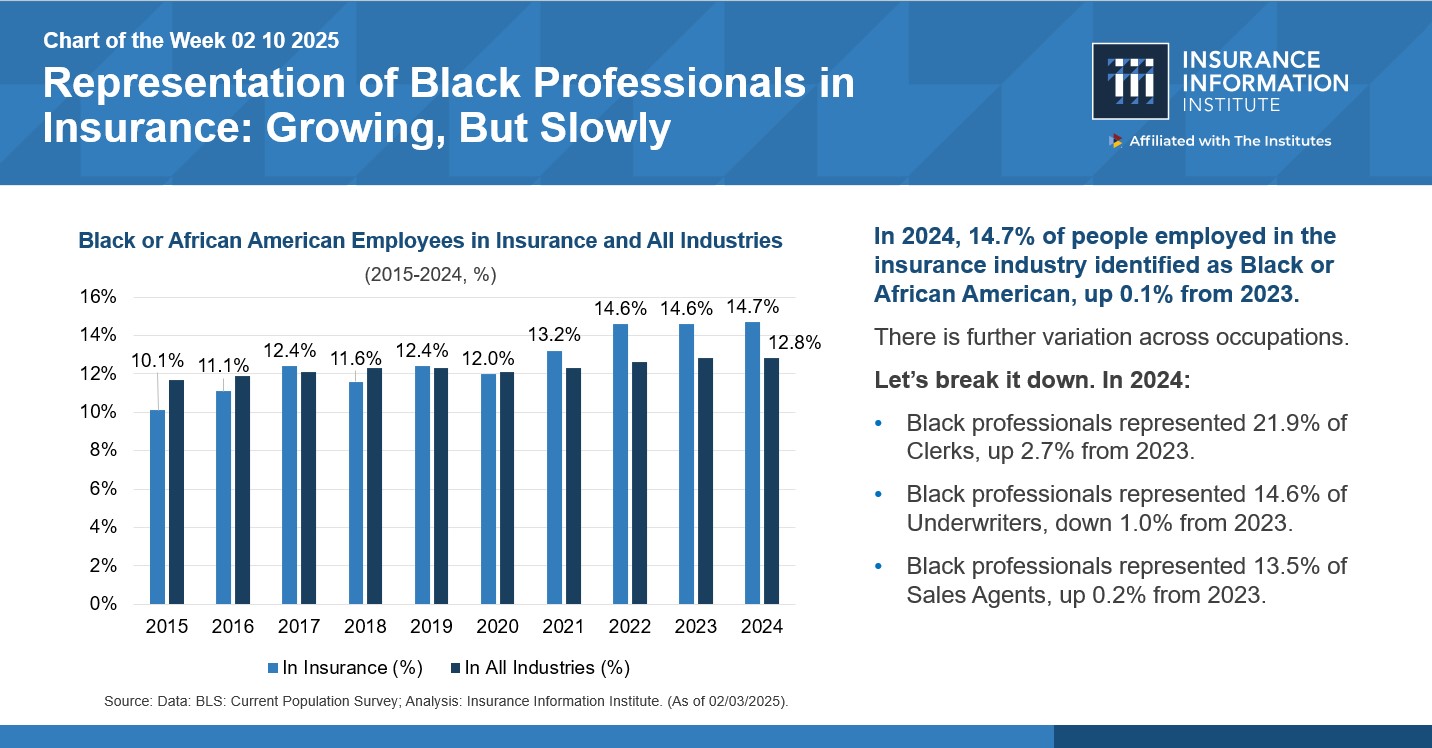

Bureau of Labor Statistics data cited in the report shows that, in 2024, Black professionals made up 14.7 percent of the insurance workforce, up from 9.9 percent 10 years ago. Yet only 1.8 percent of executives at the 10 largest insurers were Black. Research shows companies with diverse leaders benefit, however.

“BIIC’s mission is to help the industry move from awareness to action,” says Amy-Cole Smith, Executive Director for BIIC/Director of Diversity at The Institutes. “Using various data sources, our report scans Black professionals’ representation in insurance, analyzes key structural challenges, and gives recommendations for setting targets and integrating accountability.”

The collective’s new report furthers its commitment to “identifying organizational strategies that enable talent to break through mid-level ceilings and into the C-suite.” It explains how diversity in senior management can positively affect brand, organizational culture, and the bottom line. Successful outcomes can include demonstrating a commitment to diversity in both the workforce and consumer markets, expanding organizational diversity, and achieving higher profits.

The report identifies four imperatives for measurable and sustainable progress:

- Accountability and transparency with data;

- Sponsorship initiatives to support potential leaders;

- Equitable succession planning that prepares diverse candidates before leadership vacancies arise; and

- A culture of psychological safety

These findings were the result of tackling the essential question, “Why haven’t hiring gains translated into increased representation in upper management?” Inequitable hiring and promotion, biased performance reviews, limited recruitment channels, and cultures that value “fit” over actual value can weaken the leadership pipeline. Many of these issues can occur across all organizational levels, but their cumulative effect is most evident in the C-suite.

For example, the report highlights the “glass cliff” phenomenon, whereby Black and other underrepresented professionals are often only promoted to senior roles during periods of organizational crisis. Explaining the lack of adequate support and long-term strategic commitment that often accompany these highly visible promotions, the report argues that this scenario heightens the risk of failure for newly appointed leaders and reinforces biased perceptions of leadership capability.

Putting a new leader on the glass cliff creates doubt about an organization’s overall commitment to maintaining a diverse workplace. BIIC indicates that a better course of action would require a strategic commitment to equity, such as involving Black professionals in succession planning during stable periods to prepare them for long-term success, rather than being positioned as last-resort problem solvers.

There is a discussion of problematic recruiting conventions, such as the tendency of hiring managers to use the word “qualified,” particularly in conversations about expanding recruitment to include more diverse candidates. This habit can perpetuate the bias that “diverse” and “qualified” candidates are mutually exclusive groups. Further, the word “qualified” isn’t tied to specific, objective, and job-relevant criteria. The resulting ambiguity allows the personal preferences of individual hiring managers (e.g., educational background, accent, or appearance) to shape their assessment of a candidate’s suitability, rather than focus on actual skills and ability to perform the job.

Community insights collected through BIIC’s engagements with more than 4,000 professionals reveal that career advancement can be hampered by a lack of visibility, insufficient exposure to decision-makers, or unclear career advancement pathways. Participants emphasized the importance of candid communication with managers, organizational agility, and access to leadership development opportunities in overcoming these barriers.

BIIC, a five-year-old nonprofit that is an affiliate of The Institutes, has worked to provide career advancement infrastructure for Black professionals – a strong network of peers, opportunities to learn from industry executives, and expanded resources through strategic partnerships such as 2022 collaboration with Darden School of Business at The University of Virginia.

Cole-Smith says, “BIIC’s goal is not only to elevate individual careers but also transform the industry’s leadership landscape, ensuring that diverse perspectives and voices shape its future.”

The insurance industry’s future depends on serving diverse communities, which requires addressing structural challenges and investing in inclusive leadership. Fostering Black Leadership in Insurance urges prompt action and systemic transformation. Even as workforce representation improves, advancement into executive ranks can remain restricted by persistent inequities unless organizations rise to the challenge.