By Lewis Nibbelin, Contributing Writer, Triple-I

Insurance industry executives and thought leaders gathered yesterday for Triple-I’s Joint Industry Forum (JIF) in Chicago to discuss the trends, economics, geopolitics, and policy influencing the market today, as well as ways to navigate these complexities while focusing on making their products affordable and available for consumers.

Triple-I CEO Sean Kevelighan in his opening remarks, noted that effective risk management depends on collaboration across stakeholder groups, as interconnected perils “present a community problem, not just an industry problem.”

JIF keynote speaker Louisiana Insurance Commissioner Tim Temple said facilitating community resilience planning is a top priority for the National Association of Insurance Commissioners (NAIC). The NAIC’s 2025 initiative – “Securing Tomorrow: Advancing State-Based Regulation” – aims to improve disaster mitigation and recovery by consolidating “the collective expertise of experienced state regulators from across the country, who can share real-time insights and proven strategies,” Temple said.

Among the initiative’s goals is aggregating more data from insurers to better understand challenges to affordability and availability on state levels, which the NAIC can then translate into actionable policy proposals. Such data calls, Temple said, help regulators, legislators, and policyholders focus on improving the cost drivers of insurance rates.

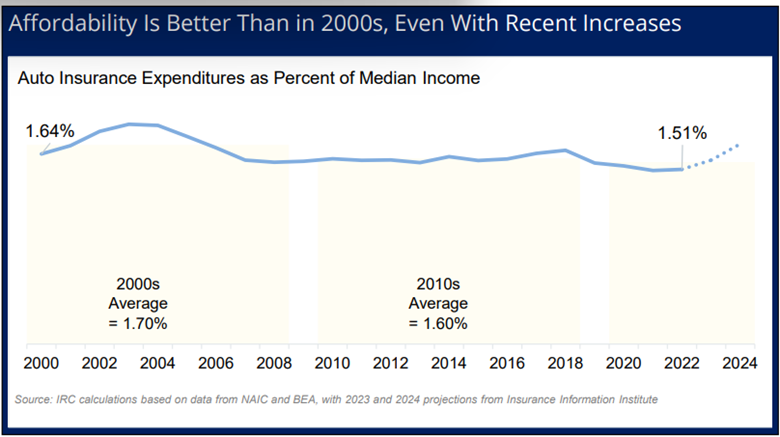

Louisiana has consistently been among the least affordable states for homeowners and auto insurance, according to the Insurance Research Council (IRC), in part because of its reputation for being plaintiff-friendly in civil litigation. Significant tort legislation has been approved in the state, but resistance to reform remains a challenge.

Getting to the roots of high premiums

After a recent data call in his home state, Temple told the JIF audience, “For the first time in Louisiana, we’re not talking about only premiums. We’re talking about why premiums are where they are.”

A critical lack of transparency surrounding cost drivers persists, however. Temple criticized the National Flood Insurance Program’s Risk Rating 2.0 reforms for not publicly disclosing more information “for individuals and communities to identify and address factors driving up their premiums,” such as “whether increased rates take into account levee systems, pump stations, and other things designed to help mitigate against floods.”

Conversely, government programs like Strengthen Alabama Homes – and the numerous programs it inspired, including in Louisiana – have demonstrated success in communicating the benefits of resilience investments for consumers and policymakers.

“We’re seeing major positive results after just a few short years,” Temple said, noting that, since early 2024, over 5,000 homeowners not chosen for Louisiana’s grant program still decided to invest in the same hazard mitigation, as they may still qualify for the corresponding state-mandated insurance discounts.

“As natural disasters become more frequent and severe, state regulators will continue to drive forward common-sense policies that protect consumers and ensure that insurance remains available and reliable for at-risk communities,” Temple concluded. Developing the database required for such policies is a necessary first step.

Keep an eye on the Triple-I Blog for further JIF coverage.

Learn More

Significant Tort Reform Advances in Louisiana

Louisiana Senator Seeks Resumption of Resilience Investment Program

Louisiana Reforms: Progress, But More Is Needed to Stem Legal System Abuse

Louisiana Is Least Affordable State for Personal Auto Coverage Across the South and U.S.

Who’s Financing Legal System Abuse? Louisianans Need to Know

Study Touts Payoffs From Alabama Wind Resilience Program

Outdated Building Codes Exacerbate Climate Risk

Resilience Investments Paid Off in Florida During Hurricane Milton