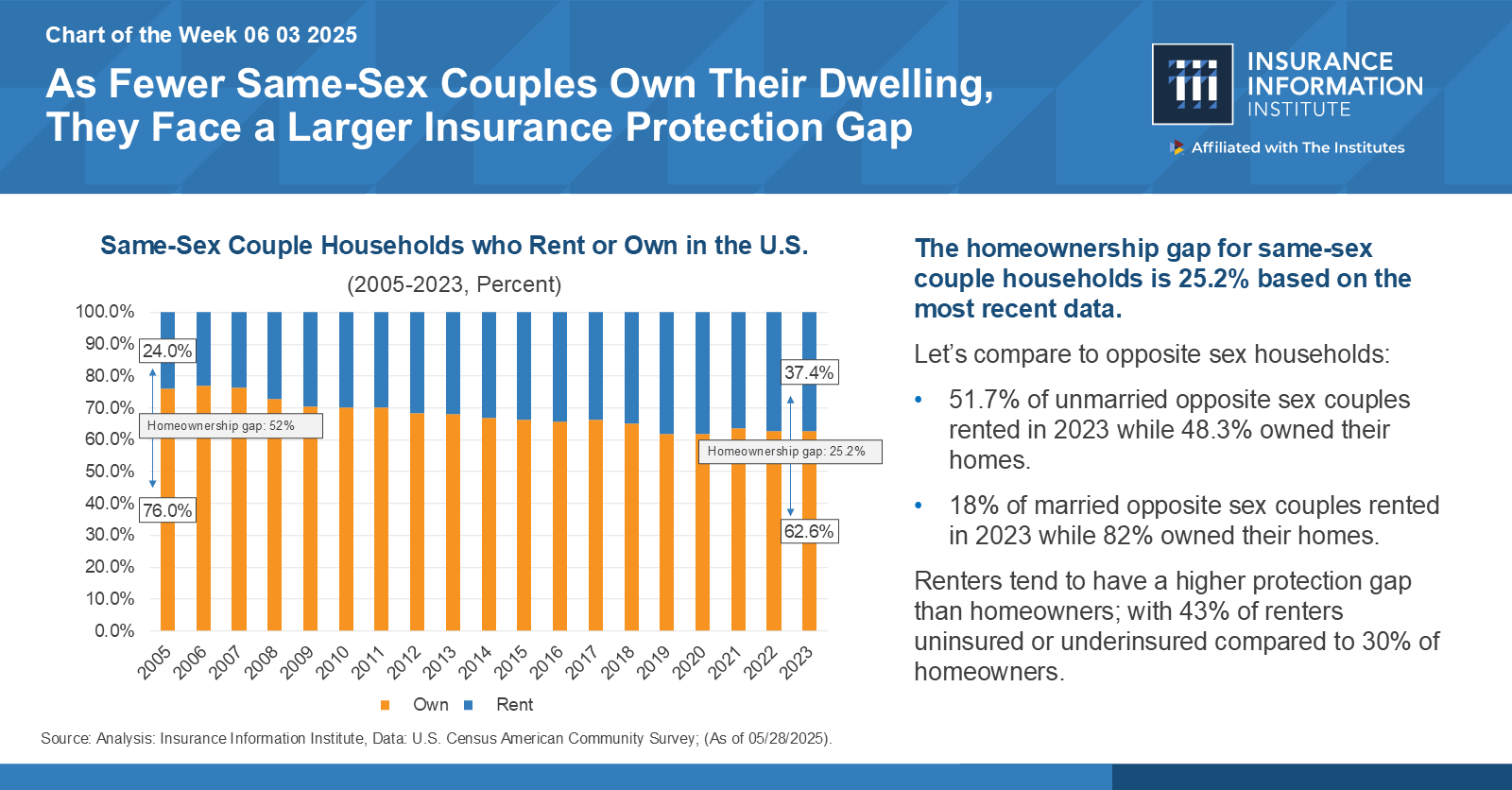

As part of an ongoing discussion on the link between the housing and insurance markets, the Insurance Information Institute (Triple-I) released a Chart of the Week (COTW), “As Fewer Same-Sex Couples Own Their Dwelling, They Face a Larger Insurance Protection Gap.” Based on data from 2023, 62.6 percent of same-sex households own their homes and 37.4 percent rent, representing a homeownership gap of 25.2 percentage points within this community. In comparison, 82 percent of married opposite-sex households own their homes, while only 18 percent rent.

In the United States, homeownership offers several benefits (versus renting) to those with the financial resources to achieve and sustain it. Owners can accrue equity to increase their chances of making a profit when they sell their home. They can reap tax benefits through mortgage deductions. Mortgage holders can also lower monthly housing costs when interest rates drop. Ultimately, a home can increase personal net worth and offer a mechanism to transfer wealth to the next generation. Protecting this asset and its contents makes good financial sense.

Renters may not own their dwelling, but they keep personal belongings in it. They can face serious financial risks in the event of a loss, theft, disaster, or personal liability event. Yet, according to the COTW, 43 percent of renters are uninsured or underinsured, compared to 30 percent of homeowners. There are several reasons attributable to this difference, but it’s essential to keep one at the forefront: insurance coverage requirements are commonplace in mortgage agreements but not in lease agreements. Thus, homeownership status can drive participation in the insurance market.

Examining factors that impede homeownership for same-sex couples might shed light on how to attract and retain more policyholders in this demographic. Looking closely at the interplay of just three of these – housing prices, geography, and legislative environment – reveals that housing tends to be more expensive in LGBTQIA+-friendly areas. Prospective buyers may need to earn at least $150,000 a year – as much as 50 percent more – to avoid living in regions without basic legal protections, according to a recent study of real estate market data across 54 major U.S. metropolitan areas.

High monthly housing costs strain budgets, pushing homeowners and renters out of the insurance market. It can also put the financial qualifications for home buying – i.e., building credit and savings – out of reach. Households are considered cost-burdened when they spend more than 30 percent of their income on rent, mortgage payments, and other housing costs, according to the U.S. Department of Housing and Urban Development (HUD).

Nationwide, renters had higher median housing costs as a percentage of their income (31.0 percent) compared to homeowners (21.1 percent for homeowners with a mortgage and 11.5 percent for those without a mortgage). In metropolitan areas that welcome and protect diversity, renters are more likely to be housing cost-burdened, particularly in New York (52.1 percent of residents pay more than 30 percent of their income) and San Francisco (37.6 percent of residents). Renters in states and municipalities where legislation is considerably less welcoming but rents are lower can face comparatively higher premiums for rental coverage.

Despite the legalization of same-sex marriage and various anti-discrimination laws, the LGBTQ community still battles considerable discrimination and systemic biases in many areas of life, including housing. Insurers can work to better understand the diverse needs of LGBTQIA+ individuals, couples, and their families, facilitating more effective solutions for managing financial risks. And most importantly, the industry can improve communication around potential coverage benefits for these households.

“We can start closing the protection gap by having people at the table who understand the lived experiences behind the numbers,” says Amy Cole-Smith, Executive Director for BIIC/ Director of Diversity at The Institutes.

For example, renters might find it helpful to know their policy covers a loss event linked to discrimination against them, such as malicious damage or vandalism to the property by a third party. Even when it’s evident the destruction isn’t the renter’s fault, the landlord might still attempt to hold them responsible, either through a lawsuit, a rent increase, or eviction. Additionally, unmarried couples should be informed about whether the insurer includes both partners’ names on a policy and how this provision affects them in the event of a claim.

“Cultivating an inclusive workforce drives smarter solutions, like renters’ insurance that aligns with the realities of same-sex couples, more equitable underwriting, and marketing that truly resonates,” Cole-Smith says. “This isn’t just about equity—it’s about unlocking growth and staying competitive in a changing market. When the insurance workforce reflects the diversity of the market, we’re in a stronger position to build products that meet people where they are.”

Triple-I works to advance the conversation around crucial issues in the insurance industry, including Talent and Recruitment. To join the discussion, register for JIF 2025. We also invite you to follow our blog to learn more about trends in insurance affordability and availability across the property/casualty market.