Wildfire risk is strongly conditioned by geographic considerations that vary widely among and within states. The latest Triple-I Issues Brief shows how that fact played out in 2024 and early this year and discusses the importance of granular local data for underwriting and pricing insurance in wildfire-prone areas, as well as for much-needed investment in resilience.

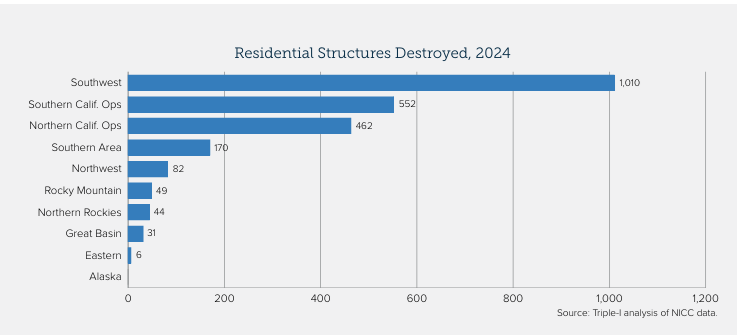

The 2024 wildfire season in the South and Southwest was particularly severe, marked by such events as the Texas and Oklahoma Panhandle fires in February and March and significant blazes in Arizona and New Mexico. The Southwest accounted for the largest number of residential structures destroyed by wildfire, and three of the top five areas for homes destroyed were in the South.

California accounted for the largest number of homes at risk for extreme wildfires. In the first half, the state experienced an above-average number of fires, though most were contained before growing to “major incident” size. Subsequent rains suppressed subsequent wildfire conditions – and caused substantial flooding.

But this rain contributed to an accumulation of fuels so that, when hurricane-force Santa Ana winds whipped through Los Angeles County in early January 2025, the conditions were right for fast-moving blazes to tear through Pacific Palisades and Eaton Canyon.

Temperature, humidity, wind, and topography vary too widely for a single “one size fits all” mitigation approach. This underscores the importance of granular data gathering and scrupulous analysis when underwriting and pricing insurance. It is also important that insurers proactively engage with diverse stakeholder groups to promote investment in mitigation and resilience.

A recent paper by Triple-I and Guidewire – a provider of software solutions to the insurance industry – uses case studies from three California areas with very different geographic and demographic characteristics to go deeper into how such tools can be used to identify properties with attractive risk properties, despite their location in wildfire-prone areas.

Learn More:

Getting Granular to Find Lower-Risk Properties Amid Wildfire Perils

P&C Insurance Achieves Best Results Since 2013; Wildfire Losses, Tariffs Threaten 2025 Prospects

Despite Progress, California Insurance Market Faces Headwinds

California Finalizes Updated Modeling Rules, Clarifies Applicability Beyond Wildfire