According to a recent Chubb survey of 800 high-net-worth individuals in the United States and Canada, 92 percent are concerned about the size of a verdict against them if they were a defendant in a liability case – yet only 36 percent have excess liability insurance.

When it comes to liability, Chubb says respondents are most worried about auto accidents, allegations of assault or harassment, and someone working in their home getting hurt. Damage awards are rising dramatically for a number of reasons, according to Laila Brabander, head of North American personal lines claims for Chubb.

“Economic damages historically were based on factors such as the extent of an injury and resultant medical expenses or past and future loss of income,” she said. “But we are seeing a rise in non-economic damages, such as pain and suffering and post-traumatic stress disorder, that overshadow actual economic losses.”

Brabander described a case in which a client at a yoga studio fell onto the person next to her and was sued by the injured party for pain and suffering.

“The same plaintiffs’ tactics to encourage large verdicts in commercial trucking, auto liability, product liability and medical malpractice suits are now being utilized to push for larger jury awards against our high-net-worth clients,” Brabander said.

Another factor driving up the cost of settlements is the third-party litigation funding, in which firms provide funding to plaintiffs and their lawyers in exchange for a percentage of the settlement. These private-equity firms began in the commercial space and are now funding lawsuits against individuals and their insurers.

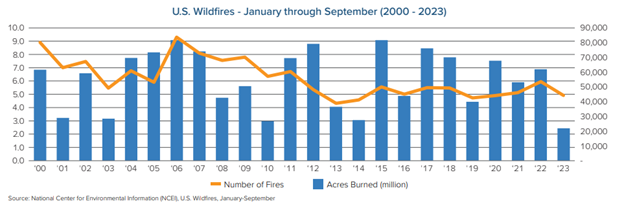

High-net-worth people also are deeply concerned about the threats posed to their homes by extreme weather and climate-related events. Much of this concern may be due to increased development in coastal areas vulnerable to tropical storms and flooding and in the wildland-urban interface – areas in which development places property into proximity with fire-prone wilderness (see links below).

Chubb’s findings are based on a survey of 800 wealthy individuals in the United States (650 respondents) and Canada (150 respondents). Respondents had investable assets of at least $500,000, with the majority reporting assets of $1.5 million to $50 million and 12 percent reporting assets of more than $50 million.

Learn More:

Triple-I Issues Brief – State of the Risk: Wildfire

Triple-I Issues Brief – State of the Risk: Hurricanes

What Is Third-Party Litigation Funding and How Does It Affect Insurance Pricing and Affordability?