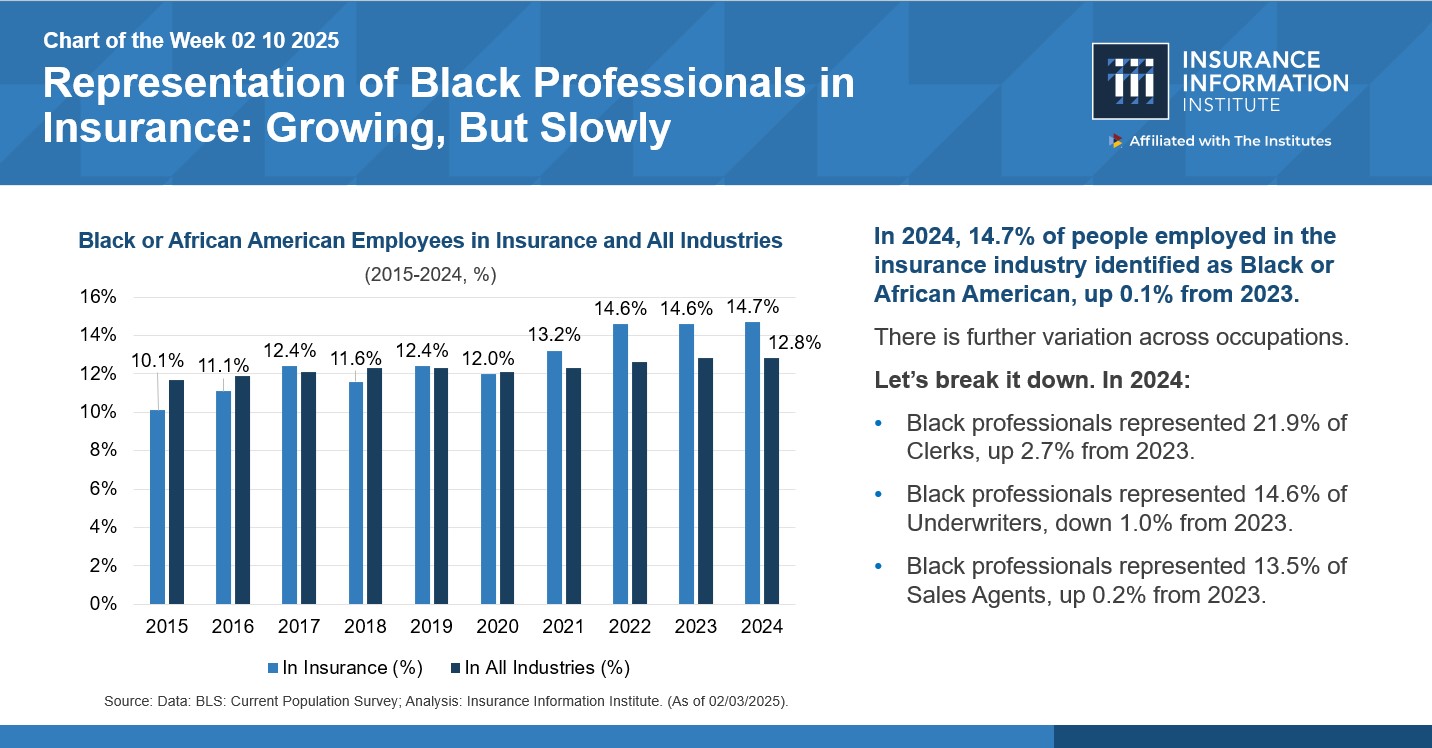

On February 10, Triple-I released its latest Chart of the Week (COTW), “Representation of Black professionals in Insurance: Growing, But Slowly.” Citing data from the Bureau of Labor Statistics, the chart reveals that in 2024, Black professionals comprised 14.7 percent of the insurance industry, just a 0.1 percent increase from 2023 but still considerably up from 9.9 percent a decade ago. Triple-I’s snapshot shows some occupation categories: underwriters comprised 14.6 percent, agents 13.5 percent, and claims and policy processing clerks 21.9 percent.

The most recent BLS data also shows Black representation among claims adjusters, appraisers, examiners, and investigators is at 20.9 percent. Last year’s version of the chart revealed (using data from 2020) that Black professionals accounted for only 1.8 percent of senior executives at the top ten US insurers. (In 2024, Black CEO representation across the Fortune 500 was only 1.6 percent, an all-time high.) Overall, insurers have welcomed Black professionals at proportions commensurate with their proportion of the overall US workforce but have not managed to make headway in the C-suite.

According to BLS data cited in an AM Best report, total employment in the industry had surpassed 3 million by August 2023. However, employers could face massive attrition as thousands of workers (along with their leadership skills and knowledge) retire from the workforce in the coming years.

Attracting and retaining top talent remains a key business strategy for organizations that want to keep delivering world-class results and growth. As the insurance industry collects revenues from virtually every household in America, a workforce that reflects this enormous marketplace can tap into a diversity of thought and experience to help address the industry’s challenges, including making products affordable and available to cover a broad range of risks.

A Boston Consulting Group study revealed that companies with above-average diversity in their leadership teams reported innovation revenue at rates 19 percentage points higher than those with below-average diversity in management. Again, the ability of the industry’s aging workforce to connect with younger generations will be pivotal. US millennials and Gen Zers command nearly $3 trillion in spending power each year.

Progress towards diverse talent recruitment and retention goals can hinge upon cultivating a workplace where all employees feel welcome, supported, fulfilled, and empowered to keep growing professionally. Nonetheless, a lack of diversity at the C-suite level can undermine efforts to incorporate driven and career-focused candidates, especially among millennials and GenZ professionals. Rising generations are wary of glass ceilings and may want proof that inclusion and equity come from the top.

Data indicates that companies tend to employ Black professionals more often in jobs that don’t typically lead to higher roles instead of taking deliberate and strategic efforts to increase Black representation in areas close to centers of profit and strategic decision-making. These employees are taken out of the line of sight for getting tapped and groomed for opportunities that can lead to the C-suite. Insurers keen on Black talent development can open opportunities for Black employees to learn about what’s above that mid-level management ceiling and make connections. Organizations such as Black Insurance Industry Collective (BIIC) offer this and other types of strategic assistance to the industry for advancing, retaining, and empowering Black talent at the executive level.

“The momentum is clear—BIIC is not just shaping the conversation but actively driving meaningful change within the insurance industry,” says Amy-Cole Smith, Executive Director for BIIC and Director of Diversity at The Institutes.

Since its inception three years ago, BIIC has endeavored to support Black leaders within the risk management and insurance industry in full partnership with some of the largest insurance organizations. To date, 22 organizations have joined forces with BIIC to advance this mission.

Cole-Smith says, “By fostering mentorship, leadership development, and strategic networking opportunities, BIIC is creating tangible pathways for Black professionals to ascend into executive roles, influence key industry decisions, and pave the way for future generations.”

In addition to engaging over 4,000 professionals through its bespoke content designed to raise awareness and foster discussion of key topics relevant to this mission, BIIC has also supported over 135 emerging, mid-level, and senior Black professional leaders through its Executive Leadership Program, a collaboration with Darden Executive Education and Lifelong Learning.

“Through its commitment to equity, inclusion, and professional excellence, BIIC is not only elevating individual careers but also transforming the industry’s leadership landscape, ensuring that diverse perspectives and voices shape its future,” according to Cole-Smith.