Even as California moves to address regulatory obstacles to fair, actuarially sound insurance underwriting and pricing, the state’s risk profile continues to evolve in ways that impede progress, according to the most recent Triple-I Issues Brief.

Like many states, California has suffered greatly from climate-related natural catastrophe losses. Like some disaster-prone states, it also has experienced a decline in insurers’ appetite for covering its property/casualty risks.

But much of California’s problem is driven by regulators’ application of Proposition 103 – a decades-old measure that constrains insurers’ ability to profitably write business in the state. As applied, Proposition 103 has:

- Kept insurers from pricing catastrophe risk prospectively using models, requiring them to price based on historical data alone;

- Barred insurers from incorporating reinsurance costs into pricing; and

- Allowed consumer advocacy groups to intervene in the rate-approval process, making it hard for insurers to respond quickly to changing market conditions and driving up administration costs.

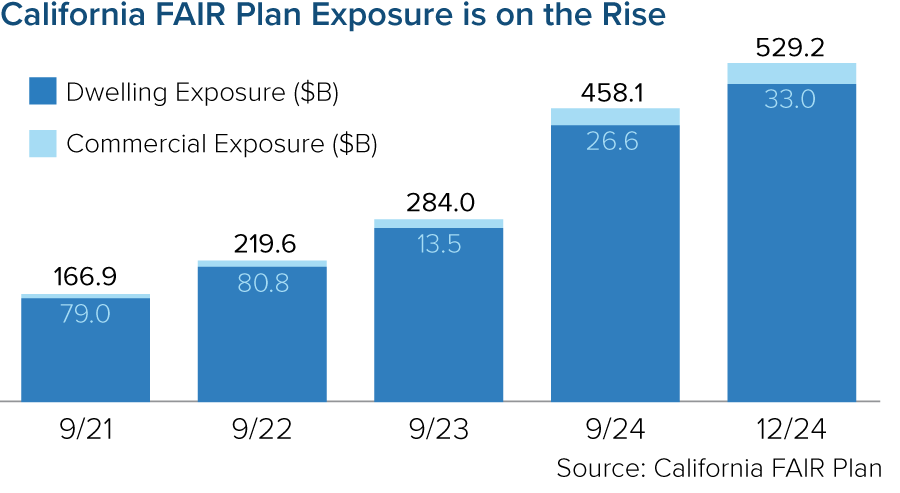

As insurers have adjusted their risk appetite to reflect these constraints, more property owners have been pushed into the California FAIR plan – the state’s property insurer of last resort. As of December 2024, the FAIR plan’s exposure was $529 billion – a 15 percent increase since September 2024 (the prior fiscal year end) and a 217 percent increase since fiscal year end 2021. In 2025, that exposure will increase further as FAIR begins offering higher commercial coverage for larger homeowners, condominium associations, homebuilders and other businesses.

Insurance Commissioner Ricardo Lara has implemented a Sustainable Insurance Strategy to alleviate these pressures. The strategy has generated positive impacts, but it continues to meet resistance from legislators and consumer groups. And, regardless of what regulators or legislators do, California homeowners’ insurance premiums will need to rise.

The Triple-I brief points out that – despite the Golden State’s many challenges – its homeowners actually enjoy below-average home and auto insurance rates as a percentage of median income. Insurance availability ultimately depends on insurers being able to charge rates that adequately reflect the full impact of increasing climate risk in the state. In a disaster-prone state like California, these artificially low premium rates are not sustainable.

“Higher rates and reduced regulatory restrictions will allow more carriers to expand their underwriting appetite, relieving the availability crisis and reliance on the FAIR plan,” said Triple-I Chief Insurance Officer Dale Porfilio.

With events like January’s devastating fires, frequent “atmospheric rivers” that bring floods and mudslides, and the ever-present threat of earthquakes – alongside the many more mundane perils California shares with its 49 sister states – premium rates that adequately reflect the full impact of these risks are essential to continued availability of private insurance.

Learn More:

California Insurance Market at a Critical Juncture

California Finalizes Updated Modeling Rules, Clarifies Applicability Beyond Wildfire