The increasing frequency and severity of claims costs beyond insurer expectations continue to threaten insurance coverage and affordability. Triple-I’s latest Issue Brief, Legal System Abuse – State of the Risk describes how trends in claims litigation can drive social inflation, leading to higher insurance premiums for policyholders and losses for insurers.

Key Takeaways

- Insured losses continue to exceed expectations and surpass inflation, notably impacting coverage affordability and availability in Florida and Louisiana.

- In promoting the term “legal system abuse”, Triple-I seeks to capture how litigation and related systemic trends amplify social inflation.

- Progress has been made toward increased awareness about the risks of third-party litigation funding (TPLF), but more work is needed.

What we mean when we talk about legal system abuse

Legal system abuse occurs when policyholders, plaintiff attorneys, or other third parties use fraudulent or unnecessary tactics in pursuing an insurance claim payout, increasing the time and cost of settling insurance claims. These actions can include illegal maneuvers, such as claims inflation and frivolous or outright fraudulent claims. Unscrupulous contractors, for example, seek to profit from Assignment of Benefits (AOBs) by overstating repair costs and then filing lawsuits against the insurer – sometimes even without the homeowner’s knowledge. Filing a lawsuit to reap an outsized payout when it’s evident the claims process will likely provide a fair, reasonable, and timely claim settlement can also be considered legal system abuse.

The latest brief provides a round-up of several studies Triple-I and other organizations conducted on elements of these litigation trends. The report, “Impact of Increasing Inflation on Personal and Commercial Auto Liability Insurance,” describes the $96 billion to $105 billion increase in combined claim payouts for U.S. personal and commercial auto insurer liability. The Insurance Research Council highlighted the dire lack of affordability for personal auto and homeowners insurance coverage in Louisiana, along with the state’s exceptionally high claim litigation rates.

Readers will also find an update on the discussion of legal industry trends associated with increased claims litigation. The lack of transparency around TPLF arrangements and the fear of outside influence on cases are attracting the attention of legislators at the state and federal levels. The brief also describes how some law firms may use TPLF resources to encourage large windfall-seeking lawsuits instead of speedy and fair claims litigation. Research findings suggest that consumers have become aware of how ubiquitous attorney ads can influence the frequency of lawsuits, increasing claims costs.

Florida: a case study in the consequences of excessive litigation

While several states, such as California, Colorado, and Louisiana, are experiencing a drastic rise in the cost of homeowners’ insurance, this brief discusses Florida. Property insurance premiums there rank the highest in the nation. Several insurers facing insurmountable losses have stopped writing new policies or left the state in the last few years. In some areas, residents are leaving, too, because of skyrocketing premiums.

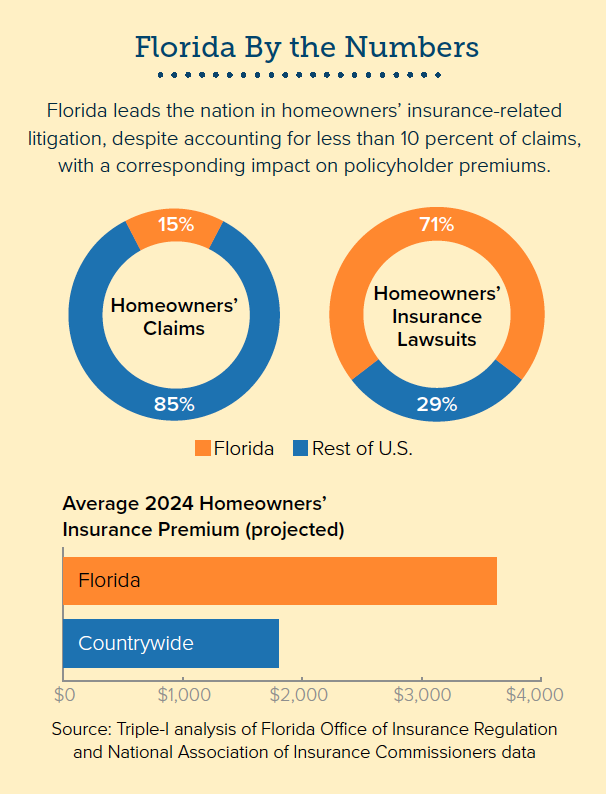

Excessive claims litigation isn’t a new issue for insurers, but it can work with other elements to shift loss ratios and disrupt forecasts, rendering cost management more challenging. In Florida, factors such as the rise in home values and frequency of extreme weather events play a significant role, along with the challenges homeowners face in the aftermath: soaring construction costs, supply chain bottlenecks, and new building codes. However, Florida also leads the nation in litigating property claims. While 15 percent of all homeowners claims in the nation originate in the state, Floridians file 71 percent of homeowners insurance lawsuits.

In Florida and elsewhere, increasing time to settle a claim puts a financial strain on insurers, which is passed on to policyholders in the form of higher premiums. Legal system abuse activities are difficult (if not impossible) to forecast and mitigate, hampering insurers’ ability to remain in the market. Therefore, legal system abuse could be one of the biggest underlying drivers of social inflation. Without preventive measures, such as policy intervention and increased policyholder awareness, coverage affordability and availability is at risk.

Triple-I remains committed to advancing the conversation and exploring actionable strategies with all stakeholders. Learn more about legal system abuse and its components, such as third-party litigation funding by following our blog and checking out our social inflation knowledge hub.