By William Nibbelin, Senior Research Actuary, Triple-I

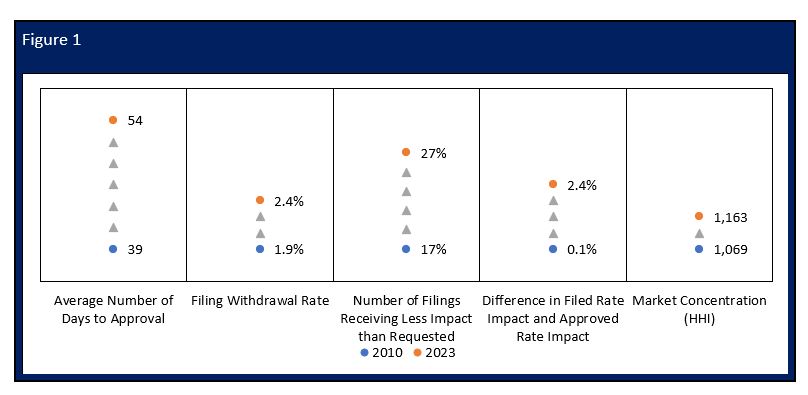

According to a new study by the Insurance Research Council (IRC), the rate filing process for personal auto insurance has become more inefficient and ineffective, taking longer to achieve rate approval with higher occurrence of approved rate impact lower than filed rate impact and a larger disparity between the rate impact approved and the rate impact filed.

The report, Rate Regulation in Personal Auto Insurance: A Comparison of State Systems, analyzes Personal Auto Insurance industry data from 2010 through 2023 across all states and the District of Columbia. Key findings:

- There were approximately 10,200 rate filings each year without much variance during the period.

- The average number of days to approval grew from 39 to 54 days.

- The number of filings withdrawn increased from 1,900 to 3,200.

- The percentage of filings receiving less rate impact than requested grew 10 points.

- The disparity in approved rate impact grew by more than 2 points.

- Market concentration (as measured by the Herfindahl-Hirschman Index, or HHI) increased by 9 percent.

- A strong-to-moderate correlation exists between net underwriting losses and premium shortfalls within states and across time.

- Filing process measures and market outcomes vary by regulatory systems.

During this same period from 2010 through 2023, the personal auto insurance industry experienced a direct combined ratio over 100 in 11 of the 14 years. Combined ratio is a key measure of underwriting profitability for insurance carriers, calculated as losses and expenses divided by earned premium plus operating expenses divided by written premium. A combined ratio over 100 represents an underwriting loss. The report includes the determination of a strong correlation between underwriting loss and premium shortfalls, defined as the potential dollar difference between the effective filed rate impact and approved rate impact.

Overview of Rate Regulation

Insurance is regulated by the states. This system of regulation stems from the McCarran-Ferguson Act of 1945, which describes state regulation and taxation of the industry as being in “the public interest” and clearly gives it preeminence over federal law.

While the regulatory processes in each state vary, three principles guide every state’s rate regulation system (Regulation | III): that rates be adequate (to maintain insurance company solvency) but not excessive (not so high as to lead to exorbitant profits) nor unfairly discriminatory (price differences must reflect expected claim and expense differences).

According to the NAIC (NAIC Auto Insurance Database Report, p. 193), the primary regulatory approaches include:

- Prior Approval System: Insurance companies must file their rates and get approval from the state insurance department before using them.

- Flex Rating: States allow insurers to change rates within a pre-established range (often a percentage increase or decrease) without needing approval. Larger changes, however, require prior approval.

- File-and-Use System: Insurers can file rates with the state and begin using them immediately or after a set period. The rates can still be reviewed by regulators, but they do not require prior approval.

- Use-and-File System: Insurers can implement new rates without prior approval but must file them with the state within a certain period after they start being used. Regulators can review and potentially disapprove them later.

- No Filing: In some states, insurers do not have to file rates for certain lines of insurance. The idea is that competition among insurers will keep rates in check. However, regulators still have authority to intervene if rates are deemed unreasonable.

Regulatory Systems

IRC used National Association of Insurance Commissioners (NAIC) definitions to segment states into four regulatory systems: Prior Approval, File and Use, Use and File (including No Filing states), and an additional segment, Rate Cap, for Flex Rating states and any state with an explicit rate impact cap on rate filings per state regulations.

The report then highlights key findings and other market outcomes across these four regulatory environment systems. For example, the study determined underwriting profitability in personal auto insurance was weakest in Rate Cap states across the period from 2010 through 2023 with the highest average direct combined ratio of any regulatory environment system in 2023. Prior Approval states had the second highest.

Below are some of the results of this study for California personal auto, which performs worse on several key rate filing process measures.

California

California has an explicit rate cap of 7 percent (California Insurance Code Article 161.05) and is therefore classified as a Rate Cap regulatory environment system in the IRC study. California only rivals Colorado for the highest average number of days to approval over the past seven years and has the highest average number of days to approval for 2023 at 246 compared to the next highest, Colorado, at 167.

California also has the highest average withdrawn rate across all states at 14.1 percent from 2010 to 2023. From 2010 to 2023, California achieved a Direct Combined Ratio under 100 four times, and the most recent three-year direct combined ratio is 110.4, compared to the countrywide 106.4. The residual market has grown in California from 0.01 percent in 2010 to 0.09 percent in 2021 which is higher than the countrywide average of 0.07 percent.