Insurance affordability in Georgia is dwindling as claim frequency and insurer costs soar, according to the latest issue brief from Insurance Information Institute (Triple-I), Trends and Insights: Georgia Insurance Affordability.

Given the state’s below-average income vs. above-average insurance expenditures, Georgia ranks 42nd on the list of affordable states for homeowners insurance and 47th (plummeting from the 2006 high of 27th) for personal auto affordability, according to reports by the Insurance Research Council. This brief provides an overview of how several factors, including skyrocketing costs from litigation, pose risks to coverage affordability, availability, and other potential economic outcomes for Georgia residents. Tort reform is discussed as a legislative solution to the challenge of legal system abuse – excessive policyholder or plaintiff attorney practices that increase costs and time to settle insurance claims.

The Georgia insurance market grapples with multiple risk factors

From 1980–2024, Georgia was impacted by 134 confirmed weather/climate disaster events in which losses exceeded $1 billion each. At least 38 of those events happened in the last five years, with 14 in 2023. Homeowners in Georgia’s most climate-risk-vulnerable counties, such as the coastal and most southern parts of the state, can face double-digit premium hikes or nonrenewals. Also, data indicates the rate of underinsured motorists in Georgia is twice as high as the national average, and the rate of uninsured motorists is 25 percent higher. Injury claim severity in the state is slightly higher than in the rest of the country.

Data indicates that litigation costs have become a pervasive concern for risk management.

Rising claim frequency and litigation costs put coverage affordability and availability at risk. For example, the IRC findings across personal auto lines show a dual trend in Georgia of increased claims and litigation. Property damage liability claims per 100 insured vehicles are 15 percent higher, and relative body injury claims frequency is 60 percent higher. According to IRC, the rate for private passenger litigation in Georgia is nearly three times that in the median state.

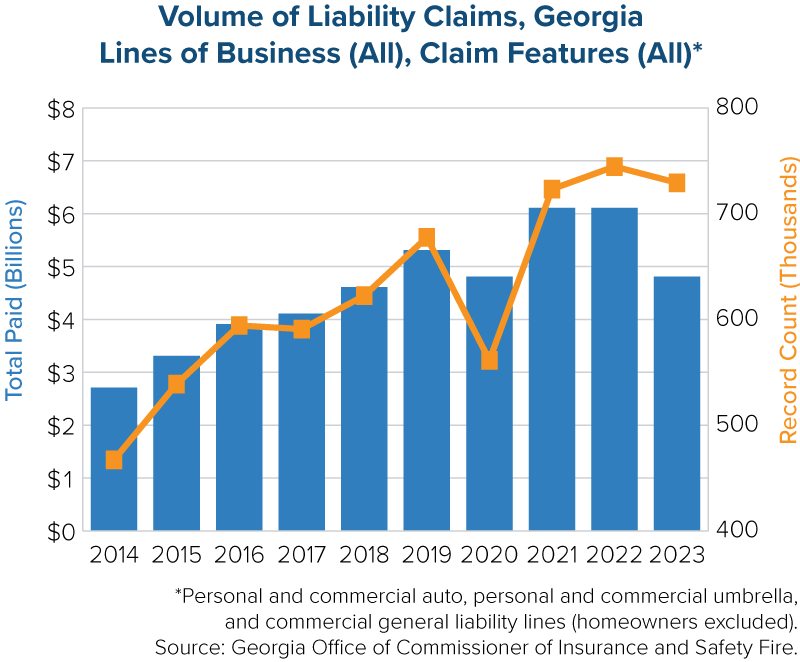

The Georgia Office of Commissioner of Insurance and Safety Fire (“OCI”) reviewed all lines across personal and commercial auto, personal and commercial umbrella, and commercial general liability (homeowners liability was excluded). The five-year average count for liability claims increased 24.9 percent (2014 – 2018 at 583,756 vs. 2019-2023 at 729,191). A rising percentage of claims with payment are full-limit claims, and the OCI analysis indicates litigation is driving that increase. While costs rose for both litigated and non-litigated claims, the number of claims with legal involvement dominated paid indemnity for most lines of business, and litigated claims comprised a growing portion of the total paid indemnity.

Attorneys appear to have revved up their mining for lawsuits in Georgia. Law firms spent $160 million on advertising in Georgia, according to preliminary data from the American Tort Reform Association (ATRA). Outdoor ads for lawsuits increased by 119 percent in GA during that time. It might not be a surprise then to see that the Georgia OCI report shows legal (attorney involved) claims dominated Personal Auto claims for Bodily Injury, comprising 62 percent of claims and 86 percent of total indemnity paid for closed claims in Accident Year 2023. A review of losses of $1 million or more by accident year that have closed during the 2014 to 2023 period shows that each accident year cohort surpasses the count from the previous accident years.

Recently introduced state tort reform legislation may help to stabilize insurance costs.

Analysts estimate that litigation costs Georgia residents $880 million annually, or an average of $1,415 per resident. Sean Kevelighan, Triple-I CEO, says “understanding how these trends drive up costs and identifying policy levers for tort reform legislation can ultimately bring positive outcomes for Georgia’s economy and its consumers and business owners.”

As part of our commitment to educating stakeholders, Triple-I has launched a multi-faceted campaign to raise awareness of the mounting costs of legal system abuse in Georgia and other states. We invite you to view the video statement by our CEO Sean Kevelighan, interviews capturing the opinions of consumers about legal system abuse, and read the full issue brief, Trends and Insights: Georgia Insurance Affordability.