By Lewis Nibbelin, Contributing Writer, Triple-I

Earlier this year, baseball-sized hailstones in Denver totaled vehicles and pummeled homes and businesses during the second-costliest hailstorm in Colorado history, equating to billions in damages. Melon-sized stones hit Texas the same month, downing power lines and requiring snow plows to reopen roads.

Hail – a sub-peril of severe convective storms (SCS), which also include thunderstorms with lightning, tornadoes, and straight-line winds – is among the most destructive natural catastrophes in the United States, behind as much as 80 percent of SCS claims in any one year. Yet hailstorms remain ill-monitored and highly unpredictable due to a lack of public and industry attention.

“These are death-by-1000-paper-cut perils,” explained Triple-I’s Non-Resident Scholar Dr. Victor Gensini, meteorology professor at Northern Illinois University and leading expert in convective storm research, in an interview for the All Eyes on Research podcast. “In general, we’re seeing hail on 200 out of 365 days of the year.”

While individual SCS events generating losses on the multi-billion-dollar scale of Hurricane Andrew or Katrina don’t happen, over the course of a given year the losses add up quickly.

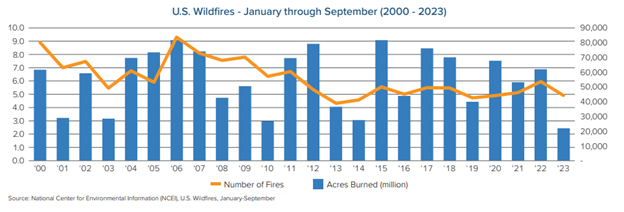

SCS, which are rising in frequency and severity – accounted for 70 percent of insured losses globally the first half of 2024, at a billion-dollar sum 87 percent higher than the previous decade average. And in 2023, U.S. insured SCS-caused losses exceeded $50 billion for the first time on record for a single year, propelled by thousands of major hailstorms impacting more than 23 million homes.

Gensini – who was motivated to study atmospheric science after a tornado impacted his high school – shifted his focus away from tornadoes “because hail is way more common across the United States every year, and it has a much larger socioeconomic impact – whether you’re talking about agricultural losses…or just rooftop damage to your asphalt shingles,” he told host and Triple-I Economic Research Analyst Marina Madsen.

“When you take a step back and look at the thunderstorm perils producing the greatest number of insured losses, it’s hail.”

Urbanization and inflation drive these losses, as more people populate disaster-prone areas and the value of their assets and the costs to repair them have increased. The expanding presence of solar farms, spread throughout flat, originally uninhabited plains, are especially susceptible to SCS damage, with one 2019 hailstorm causing $70 million in damages to a solar energy project in Texas.

Another explanation for greater hail-related losses is our warming climate. A Climate and Atmospheric Science study led by Gensini projects that, while higher temperatures will melt more hailstorms overall, increasingly large hailstones will become more common. Stronger updrafts fueled by higher temperatures can suspend stones in the air for longer, spurring further growth.

Such trends do not bode well for insurance premium rates, but upcoming research efforts promise actionable insight into hailstorm detection and prediction. The In-situ Collaborative Experiment for the Collection of Hail in the Plains – or ICECHIP – will send Gensini and several other researchers into the Great Plains to chase and collect granular data from hailstorms next year. Backed by the National Science Foundation with more than $11 million in funding, the field study aims to reduce hail risk through improved hailstorm forecasting, enabling residents to better protect themselves and their belongings before a hailstorm touches down.

A newer initiative – the Center for Interdisciplinary Research on Convective Storms, or CIRCS – is a prospective academic industry consortium to develop multidisciplinary research on SCS risk, fostering resilience and recovery strategies informed by diverse stakeholder partnerships.

“As you can imagine, the greatest interest right now in our research is in the insurance and reinsurance verticals,” Gensini said. “Hopefully, as we continue to build relationships…the [CIRCS] center will serve as a hub for information and knowledge creation for industry members. It’s a really unique consortium and a lot of potential lines of business could benefit from it.”