The Trump Administration’s unwinding of the Building Resilient Infrastructure and Communities (BRIC) program and cancellation of all BRIC applications from fiscal years 2020-2023 reinforce the need for collaboration among state and local government and private-sector stakeholders in climate resilience investment.

Congress established BRIC through the Disaster Recovery Reform Act of 2018 to ensure a stable funding source to support mitigation projects annually. The program has allocated more than $5 billion for investment in mitigation projects to alleviate human suffering and avoid economic losses from floods, wildfires, and other disasters. FEMA announced on April 4 that it is ending BRIC .

Chad Berginnis, executive director of the Association of State Floodplain Managers (ASFPM), called the decision “beyond reckless.”

“Although ASFPM has had some qualms about how FEMA’s BRIC program was implemented, it was still a cornerstone of our nation’s hazard mitigation strategy, and the agency has worked to make improvements each year,” Berginnis said. “Eliminating it entirely — mid-award cycle, no less — defies common sense.”

While the FEMA press release called BRIC a “wasteful, politicized grant program,” Berginnis said investments in hazard mitigation programs “are the opposite of ‘wasteful.’ “ He pointed to a study by the National Institute of Building Sciences (NIBS) that showed flood hazard mitigation investments return up to $8 in benefits for every $1 spent.

“At this very moment, when states like Arkansas, Kentucky, and Tennessee are grappling with major flooding, the Administration’s decision to walk away from BRIC is hard to understand,” Berginnis said.

Heading into hurricane season

Especially hard hit will be catastrophe-prone Florida. Nearly $300 million in federal aid meant to help protect communities from flooding, hurricanes, and other natural disasters has been frozen since President Trump took office in January, according to an article in Government Technology.

The loss of BRIC funding leaves dozens of Florida projects in limbo, from a plan to raise roads in St. Augustine to a $150 million effort to strengthen canals in South Florida. According to Government Technology, the agency most impacted is the South Florida Water Management District, responsible for maintaining water quality, controlling the water supply, ecosystem restoration and flood control in a 16-county area that runs from Orlando south to the Keys.

“The district received only $6 million of its $150 million grant before the program was canceled,” the article said. “The money was intended to help build three structures on canals and basins in North Miami -Dade and Broward counties to improve flood mitigation.”

Florida’s Division of Emergency Management must return $36.9 million in BRIC money that was earmarked for management costs and technical assistance. Jacksonville will lose $24.9 million targeted to raise roads and make improvements to a water reclamation facility.

FEMA announced the decision to end BRIC the day after Colorado State University’s (CSU) Department of Atmospheric Science released a forecast projecting an above-average Atlantic hurricane season for 2025. Led by CSU senior research scientist and Triple-I non-resident scholar Phil Klotzbach CSU research team forecasts 17 named storms, nine hurricanes – four of them “major” (Category 3, 4, or 5). A typical season has 14 named storms, seven hurricanes – three of them major.

Nationwide impacts

More than $280 million in federal funding for flood protection and climate resilience projects across New York City — “including critical upgrades in Central Harlem, East Elmhurst, and the South Street Seaport” – is now at risk, according to an article in AMNY. The cuts affect over $325 million in pending projects statewide and another $56 million of projects where work has already begun.

Senate Majority Leader Chuck Schumer and Gov. Kathy Hochul warned that the move jeopardizes public safety as climate-driven disasters become more frequent and severe.

“In the last few years, New Yorkers have faced hurricanes, tornadoes, blizzards, wildfires, and even an earthquake – and FEMA assistance has been critical to help us rebuild,” Hochul said. “Cutting funding for communities across New York is short-sighted and a massive risk to public safety.”

According to the National Association of Counties, cancellation of BRIC funding has several implications for counties, including paused or canceled projects, budget and planning adjustments, and reduced capacity for long-term risk reduction.

North Dakota, for example, has 10 projects that were authorized for federal funding. Those dollars will now be rescinded. Impacted projects include $7.1 million for a water intake project in Washburn; $7.8 million for a regional wastewater treatment project in Lincoln; and $1.9 million for a wastewater lagoon project in Fessenden.

“This is devastating for our community,” said Tammy Roehrich, emergency manager for Wells County. “Two million dollars to a little community of 450 people is huge.”

The cancellation of BRIC roughly coincides with FEMA’s decision to deny North Carolina’s request to continue matching 100 percent of the state’s spending on Hurricane Helene recovery.

“The need in western North Carolina remains immense — people need debris removed, homes rebuilt, and roads restored,” said Gov. Josh Stein. “Six months later, the people of western North Carolina are working hard to get back on their feet; they need FEMA to help them get the job done.”

Resilience key to insurance availability

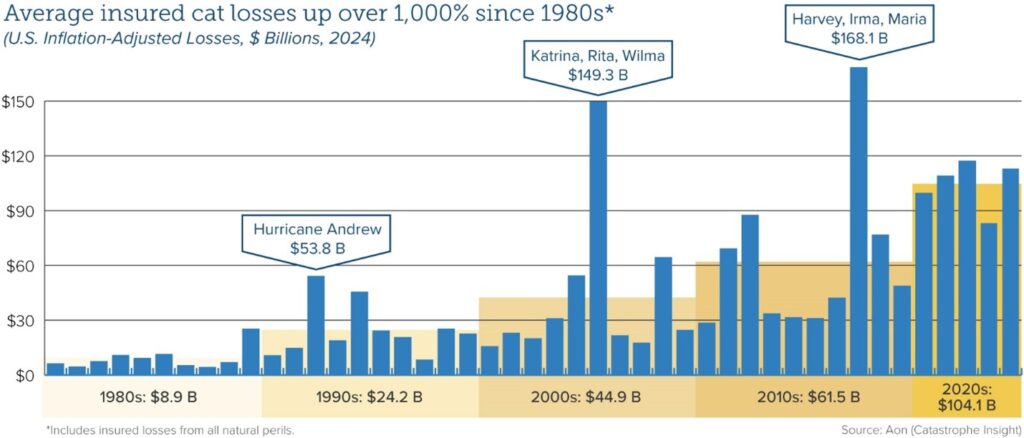

Average insured catastrophe losses have been on the rise for decades, reflecting a combination of climate-related factors and demographic trends as more people have moved into harm’s way.

“Investing in the resilience of homes, businesses, and communities is the most proactive strategy to reducing the damage caused by climate,” said Triple-I Chief Insurance Officer Dale Porfilio. “Defunding federal resilience grants will slow the essential investments being made by communities across the U.S.”

Flood is a particularly pressing problem, as 90 percent of natural disasters involve flooding, according to the National Flood Insurance Program (NFIP). The devastation wrought by Hurricane Helene in 2024 across a 500-mile swath of the U.S. Southeast – including Florida, Georgia, the Carolinas, Virginia, and Tennessee – highlighted the growing vulnerability of inland areas to flooding from both tropical and severe convective storms, as well as the scale of the flood-protection gap in non-coastal areas.

Coastal flooding in the U.S. now occurs three times more frequently than 30 years ago, and this acceleration shows no signs of slowing, according to recent research. By 2050, flood frequency is projected to increase tenfold compared to current levels, driven by rising sea levels that push tides and storm surges higher and further inland.

In addition to the movement of more people and property into harm’s way, climate-related risks are exacerbated by inflation (which drives up the cost of repairing and replacing damaged property); legal system abuse, (which delays claim settlements and drives up insurance premium rates); and antiquated regulations (like California’s Proposition 103) that discourage insurers from writing business in the states subject to them.

Thanks to the engagement and collaboration of a range of stakeholders, some of these factors in some states are being addressed. Others – for example, improved building and zoning codes that could help reduce losses and improve insurance affordability – have met persistent local resistance.

As frequently reported on this blog, the property/casualty insurance industry has been working hard with governments, communities, businesses, and others to address the causes of high costs and the insurance affordability and availability challenges that flow from them. Triple-I, its members, and partners are involved in several of these efforts, which we’ll be reporting on here as they progress.

Learn More:

Tariff Uncertainty May Strain Insurance Markets, Challenge Affordability

Claims Volume Up 36% in 2024; Climate, Costs, Litigation Drive Trend

Triple-I Brief Highlights Rising Inland Flood Risk

Tenfold Frequency Rise for Coastal Flooding Projected by 2050

Hurricane Helene Highlights Inland Flood Protection Gap

Removing Incentives for Development From High-Risk Areas Boosts Flood Resilience

Executive Exchange: Using Advanced Tools to Drill Into Flood Risk