(Photo by Jonathan Sloane/Getty Images)

By Lewis Nibbelin, Contributing Writer, Triple-I

Withdrawing federal subsidies in climate-vulnerable areas can deter development and promote disaster resilience, according to a recent Nature Climate Change study. The study found that these benefits extend beyond the targeted areas.

These findings underscore the utility of land conservation as hazard protection, as well as the critical role financial incentives play in driving – or obstructing – resilience.

A natural experiment

“Empirical research into this question is limited because few policy experiments exist where a clear comparison can be made of ‘treatment’ settings, where incentives for development have been removed, and ‘control’ settings, similar areas where such incentives remain,” the study states. “One such experiment does exist, however.”

The 1982 Coastal Barrier Resources Act (CBRA) rendered more than one million acres along U.S. coasts ineligible for various incentives, including access to flood insurance through the National Flood Insurance Program (NFIP). Though development in these high-risk areas remains legal, the CBRA shifts total responsibility onto property owners to manage that risk.

Decades later, areas under the CBRA have 83 percent fewer buildings per acre than similar non-designated areas, leading to higher development densities in less risky neighboring areas. Subsequent reductions in flood damages have generated hundreds of millions in NFIP savings per year – due not only to NFIP ineligibility in CBRA areas, but also to fewer and less costly flood claims filed in neighboring areas.

Neighboring areas benefit from the natural infrastructure provided by undeveloped wetlands, which can ease flood risk severity by impeding the rate and flow of flooding.

Housing demand a challenge

Despite the evident value of limiting development in high-risk areas, such limitations are challenging to implement during a nationwide affordable housing shortage. Navigating housing demands in tandem with a rise in natural disasters will require a coordinated effort on local, state, and federal levels.

One approach is FEMA’s Community Rating System (CRS), a voluntary program that incentivizes local floodplain management practices exceeding the NFIP’s minimum standards. Class 1 is the highest rating, qualifying residents for a 45 percent reduction in their premiums. Of the nearly 23,000 participating NFIP communities, only 1,500 participate in the CRS. Of those 1,500, only two have achieved the highest rating: Tulsa, Okla., and Roseville, Calif.

While high ratings are difficult to secure, investments in flood planning yield long-term gains via safer infrastructure and more affordable premiums, with discounts in lower-rated jurisdictions still equating to millions in savings.

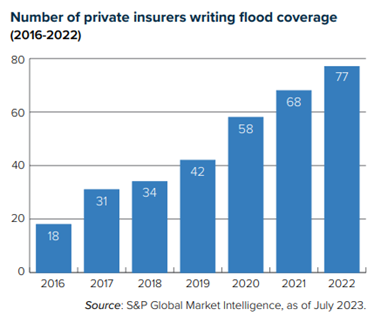

CRS discounts are especially advantageous following NFIP’s Risk Rating 2.0 reforms and increased private-sector interest in flood risk. Both have contributed to a more representative and actuarially sound flood insurance market that sets rates based on property-specific risks, thereby raising the premiums of riskier property owners.

Concerns about effective climate risk mitigation strategies persist, however – especially in the wake of unprecedented destruction wrought by Hurricane Helene.

While NFIP reforms are making flood insurance more equitable, many homeowners – including many of those most impacted by Hurricane Helene – are unaware that flood coverage is not offered by a standard homeowners policy. Likewise, many believe that flood insurance is necessary only if required by their lenders, leaving inland residents more susceptible to costly flood damages.

This lack of common knowledge about insurance is not a failure of consumers – rather, it represents the insurance industry’s urgent need to provide greater outreach, public education, and stakeholder collaboration.

Incentivizing public-private collaboration has demonstrated success, so removing federal incentives from additional high-risk areas would require extensive multidisciplinary coordination to prevent inadvertently widening the insurance protection gap. Emerging approaches to risk mitigation and resilience – such as community-based catastrophe insurance, New York City’s recent parametric insurance flood pilot, and the nation’s first public wildfire catastrophe model in California – offer opportunities for fairer rates and targeted local resilience.

If paired with policies based on the CBRA, such innovations could help ensure that appropriate risk transfer occurs alongside substantial risk reduction.

Learn More:

Triple-I “State of the Risk” Issues Brief: Flood

Executive Exchange: Using Advanced Tools to Drill Into Flood Risk

Accurately Writing Flood Coverage Hinges on Diverse Data Sources

Lee County, Fla., Towns Could Lose NFIP Flood Insurance Discounts

Miami-Dade, Fla., Sees Flood-Insurance Rate Cuts, Thanks to Resilience Investment

Milwaukee District Eyes Expanding Nature-Based Flood-Mitigation Plan

Attacking the Risk Crisis: Roadmap to Investment in Flood Resilience

It’s not too late to register for Triple-I’s Joint Industry Forum: Solutions for a New Age of Risk. Join us in Miami, Nov. 19 and 20.