Severe convective storms (SCS) are emerging as a major driver of U.S. property insurance costs, with large hail events alone damaging nearly 600,000 homes in 2024, according to an analysis by CoreLogic.

SCS weather events, which include damaging hail, tornadoes, straight-line winds and derechos, are becoming a significant driver of insured natural disaster losses across the U.S. While hurricanes and wildfires often receive more attention, these intense storms are causing considerable damage, CoreLogic noted.

Scale of Current Damage

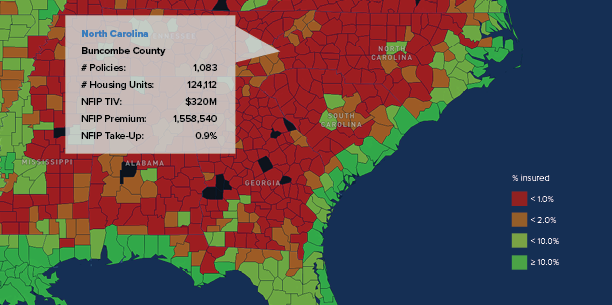

In 2024, damaging hail of two inches or greater affected 567,000 single- and multifamily homes across the contiguous U.S. The combined reconstruction cost value (RCV) of these properties is approximately $160 billion. Texas, Nebraska, Missouri, Oklahoma, and Kansas account for 72% of the homes at risk for damaging hail.

The pattern of these storms is shifting. While 2024 saw 133 days of damaging hail—above the 20-year average of 121 days—storm activity is evolving. Rather than extended periods of severe weather, there’s a trend toward more concentrated events, the report explained.

These localized storms can strain resources and claims processing systems, creating challenges for insurers and claims managers. On Sept. 24, a single event in Oklahoma City damaged 35,000 homes, making it the most impactful single hail event of 2024. A derecho that struck Downtown Houston last May caused more damage to “hurricane-proof” buildings than Hurricane Beryl in July, according to a recent study.

Property at Risk from SCS

Hailstorms pose a threat to 41 million homes at moderate or greater risk, representing a reconstruction cost value (RCV) of $13.4 trillion, according to CoreLogic’s risk score models. For tornadoes, 66 million homes are at risk, valued at $21 trillion RCV. Straight-line winds affect 53 million homes with an RCV of $18.6 trillion.

Texas, with 8.1 million homes at moderate or greater risk, has the highest concentration of risk across all storm categories, due to its size and geographic position, according to CoreLogic. The Central U.S. shows the highest overall concentration of SCS risk.

Chicago is the metropolitan area most at risk in all three SCS risk categories, with approximately 3 million homes at risk for each type of severe weather event, the report found. For tornado risk, Dallas and Miami follow Chicago as the most exposed urban centers.

Changing Environmental Conditions

Warmer sea surface temperatures and increased atmospheric moisture are altering storm patterns, according to CoreLogic. The traditional SCS season is expanding, with storms appearing earlier in spring and continuing later into fallTornado impacts are also shifting much further east than historical norms, impacting Midwest states such as Illinois, Indiana, Michigan and Ohio.

Analysts have examined three greenhouse gas emissions representative concentration pathways (RCPs): RCP 4.5, 7.0, and 8.5, projecting outcomes through 2030 and 2050, the report noted. These scenarios indicate a shifting geography of SCS risk, with the South and Midwest facing projected increases.

By 2050, the South and Midwest are expected to see increased SCS activity, including large hail, strong winds, and tornadoes, the analysis found. This shift correlates with elevated atmospheric instability, particularly in higher emissions scenarios.

For the insurance sector, these projections indicate a need for refined risk models and improved infrastructure in emerging high-risk areas. Geographic risk exposure management will become increasingly important as SCS events evolve, according to CoreLogic.

View the full SCS report here.