By William Nibbelin, Senior Research Actuary, Triple-I

The U.S. property/casualty insurance industry demonstrated notable resilience throughout 2025, navigating a landscape marked by significant regional catastrophes and shifting economic pressures, according to the latest Insurance Economics and Underwriting Projections: A Forward View report from Triple-I and Milliman.

As the industry moves into 2026, the report notes, it does so from a position of historical strength yet faces an increasingly nuanced outlook shaped by market softening and lingering macroeconomic uncertainties.

The Triple-I/Milliman report is based on data through the third quarter of 2025,

Industry-Wide Performance and Profitability

The P/C insurance industry is forecast to achieve its lowest net combined ratio (NCR) in over a decade for the full year 2025. This achievement is particularly significant, given the challenges faced early in the year, including the devastating Los Angeles wildfires in January 2025.

A key driver of this success was the first Atlantic hurricane season with no U.S. landfall in 10 years. However, while profitability reached peak levels, top-line growth began to moderate. Aggregate net premium growth across all lines for 2025 is expected to be 5.9 percent, reflecting a continued slowing of the growth rate compared to 2024.

“We’re on track to achieve the lowest net combined ratio in over a decade, thanks in part to a hurricane season that spared the U.S. and strong homeowners performance, even after the Los Angeles fires in Q1 2025,” said Patrick Schmid, Ph.D., chief insurance officer at Triple-I. “Growth in personal lines premiums remains solid, and the narrowing gap between personal and commercial lines performance points to a cautiously optimistic outlook for the industry.”

Economic Outlook: Stability Meets Vulnerability

While the broader U.S. economy and the P/C sector remain stable, economists are keeping a close watch on emerging risks. The industry’s ability to maintain its momentum in 2026 may be tested by rising political and geopolitical tensions, as well as potential shifts in the labor market.

“Overall, the P/C insurance industry and the broader U.S. economy remain stable,” said Michel Léonard, Ph.D., CBE, chief economist and data scientist at Triple-I. “However, despite stronger-than-expected GDP growth in the third quarter, a closer look at the data suggests the U.S. economy may be increasingly vulnerable to rising economic, political, and geopolitical uncertainty. In particular, P/C replacement costs could still see significant increases in 2026, weighing on overall P/C performance.”

Léonard further highlighted that the labor market serves as a critical indicator, noting that a rise in the unemployment rate toward 5.0% over the next six months could potentially trigger an economic contraction.

Underwriting Results by Line of Business

Personal lines continue to anchor the industry’s profitability. Personal auto remains a standout performer with a forecast 2025 NCR of 94.4, an improvement over 2024 results. However, premium growth in this sector has slowed significantly, with net written premium growth expected to land at 3.6 percent — its lowest level since 2020. Homeowners’ insurance also showed remarkable recovery. Despite the heavy losses from the Los Angeles fires in the first quarter, the line’s 2025 NCR is forecast at 99.6, placing it on par with 2024 performance.

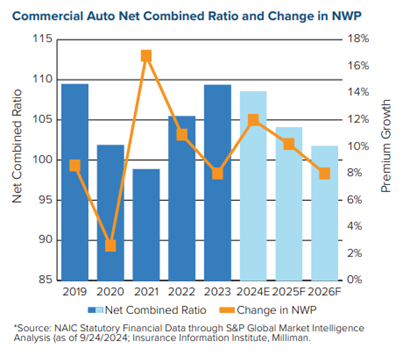

Commercial lines continue to face ongoing challenges in liability. While most of the industry enjoys profitability, general liability and commercial auto remain the only major lines forecast to stay above a 100 NCR for 2025. General liability continues to struggle with the highest Q3 direct incurred loss ratio reported in over 15 years.

Jason B. Kurtz, FCAS, MAAA, principal and consulting actuary at Milliman, detailed these persistent hurdles.

“General liability faces continued challenges,” Kurtz said. “Our 2025 net combined ratio is forecast to be similar to 2024, among the worst in over a decade. Losses are high, with Q3 direct incurred loss ratios being the highest in at least 25 years.”

He added, “While conditions may improve in 2026-2027, profitability remains a hurdle. Our general liability’s NCR expectations have risen following a challenging Q3, reflecting ongoing pressure in the segment. While some coverages are experiencing soft market conditions, aggregate premiums have been growing, but not enough to keep pace with loss trends. We anticipate additional premium growth will be needed to improve general liability profitability.”

Workers’ compensation remains the strongest performing major line, with NCRs forecast to stay in the high 80s to low 90s through 2027. This sustained success is attributed to disciplined risk management and favorable prior accident year development.

“NCCI’s latest loss ratio trends continue to show declines,” said Donna Glenn, NCCI chief actuary. “In the current environment, modest year-to-year decreases are still expected.” Glenn noted that “while there have been a few rate increases filed in NCCI states, every state has its own story, and based on the latest data, NCCI does not anticipate any imminent reversal of current trends.”