By Lewis Nibbelin, Contributing Writer, Triple-I

Analysis based on granular, cutting-edge data is essential to staying ahead in our rapidly shifting risk landscape. During Triple-I’s Joint Industry Forum in Chicago, two “Risk Take” presenters dove deep into the innovative data initiatives they engaged in to help turn these challenges into new opportunities for insurers.

Balancing consumer needs

With natural catastrophe frequency and supply chain uncertainty on the rise, so are home maintenance costs. Estimated to exceed $10,000 annually in 2024 – at a 5.9 percent year-over-year increase – home maintenance further weighs against the mounting costs of premium rates and property taxes across the U.S., leading many homeowners to forgo investing in at-home risk mitigation like smart home telematics.

“Across the providers we’ve talked to, adoption of telematics falls somewhere between the single digits,” said presenter James Bilodeau, CEO and founder of PreFix Inc. “The reason is simple: the value proposition of what we would like homeowners to do isn’t important enough compared to what homeowners actually need.”

For Bilodeau, the solution is also simple: combine advanced technology with routine preventative maintenance. By providing personalized, year-round home repair, Bilodeau’s Texas-based firm aims to mitigate losses while gathering unique primary data on the properties they service. Insurers can use this data to develop telematics technology and more accurately price the associated risks.

Such data collection “creates a flywheel in which we help our partners delight their customers with exceptional service and hit directly at affordability issues, both with home maintenance and in premium reduction,” Bilodeau said.

After a successful pilot program, USAA expanded its partnership with the company to offer discounted maintenance services to members who sign up for PreFix. Noting that the company is pursuing partnerships with other major insurers, Bilodeau highlighted that industry collaboration is crucial to not only facilitate more refined coverage but to lower the cost of entry to enhancing resilience.

Emerging public safety risks

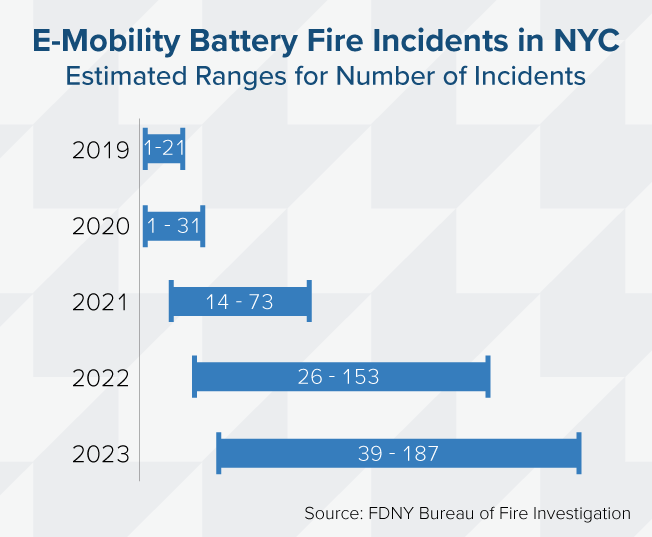

An eightfold increase in New York City fire incidents between 2019 and 2023 correlates strongly with the growing popularity of e-mobility devices, according to a joint report by UL Standards & Engagement (ULSE) and Oxford Economics that is based in part on Triple-I data.

Presenting on the report, ULSE Director of Insights Sayon Deb explained how lithium-ion battery fires linked to e-bikes and scooters became a mainstream risk for COVID-era urban environments, due in part to the booming online food and grocery delivery market.

“Nearly $519 million worth of damages were caused in just four years from structural property damage, injuries, and loss of life,” Deb said, pointing out that this figure does not account for “the additional cost of communal fear, in terms of fires happening across the hallway from you, and also the loss in economic opportunities and the community toll that it takes as we respond to these fires.”

Inadequate public safety awareness, paired with the easy availability of uncertified devices, helped fuel the crisis. Beyond overusing or incorrectly charging the devices, e-mobility users often left them in dangerous locations, with “66 percent of those who charge at home charging their devices near their exit,” Deb explained – effectively “blocking your exit from your home in the event of a fire.”

E-mobility regulations vary wildly by state. Though New York City regulations passed in 2023 show progress, ULSE recommends more proactive public outreach, safety standard enforcement, and incident reporting to better track e-mobility risk data.

“The better the data we collect, the better we can understand where, how, and why these battery fires occur, so that we can prevent future fires from happening,” Deb concluded.

Learn More:

JIF 2025: U.S. Policy Changes and Uncertainty Imperil Insurance Affordability

JIF 2025: Litigation Trends, Artificial Intelligence Take Center Stage

Insurance Affordability, Availability Demand Collaboration, Innovation

E-Mobility Battery Fire Data Exposes Potential “Blind Spot” for Insurers