Even as California moves to address regulatory obstacles to fair, actuarially sound insurance underwriting and pricing, the state’s risk profile continues to evolve in ways that underscore the importance of risk-based insurance pricing and investment in mitigation and resilience.

Triple-I’s latest “State of the Risk” Issues Brief discusses this changing risk environment and the impact of Proposition 103 – a three-decades-old measure that has made it hard for insurers to profitably write coverage in the state. In a dynamically evolving risk environment that includes earthquakes, drought, wildfire, landslides, and — in recent years, due to “atmospheric rivers” — damaging floods, Proposition 103 has prevented insurers from using the most current data and advanced modeling technologies. Instead, it has required them to price coverage based on historical data alone.

It also has restricted accurate underwriting and pricing by not allowing insurers to incorporate the cost of reinsurance into their pricing. Insurers use reinsurance to maximize their capacity to write coverage, and reinsurance rates have been rising for many of the same reasons as primary insurance rates. If insurers can’t reflect reinsurance costs in their pricing – particularly in catastrophe-prone areas – they must pay for these costs from policyholder surplus, reduce their market share in the state, or do both.

Proposition 103 also has impeded premium rate changes by allowing consumer advocacy groups to intervene in the rate-approval process. This makes it hard to respond quickly to changing market conditions, resulting in approval delays and rates that don’t accurately reflect current (let alone future) risk. It also drives up legal and administrative costs.

This has led, in some cases, to insurers deciding to limit or reduce their business in the state. With fewer private insurance options available, more Californians are resorting to the state’s FAIR Plan, which offers less coverage for a higher premium.

This isn’t a tenable situation.

In September 2023, California Insurance Commissioner Ricardo Lara announced a Sustainable Insurance Strategy for the state that includes allowing insurers to use forward-looking risk models that prioritize wildfire safety and mitigation and include reinsurance costs into their premium pricing. In exchange, insurers must cover homeowners in wildfire-prone parts of the state at 85 percent of their statewide coverage.

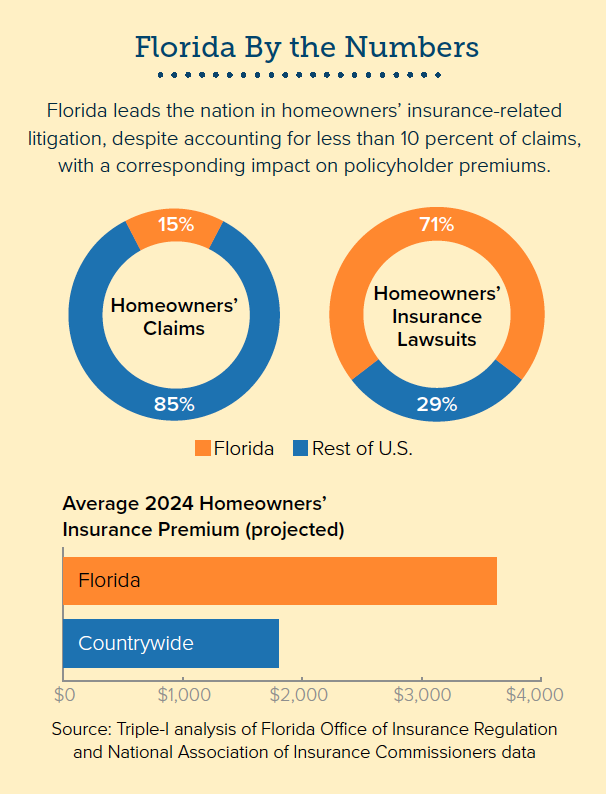

Issues around property insurance affordability are not confined to California. They’ve been a long time in the making, and they won’t be resolved overnight.

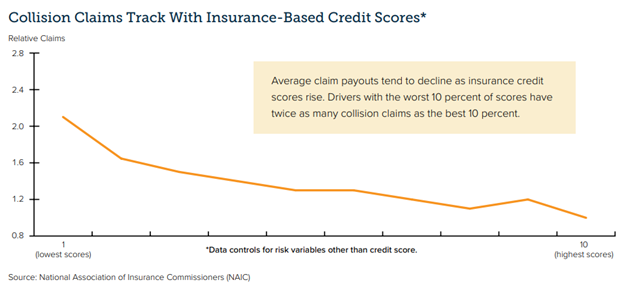

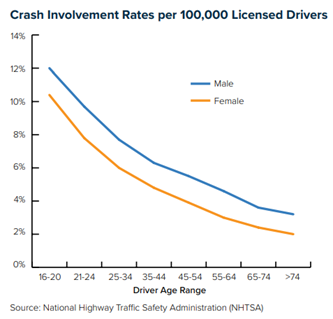

“Any sustainable solutions will have to rest on actuarially sound underwriting and pricing principles,” the Triple-I brief says. “Unfortunately, too often, the public discourse frames the risk crisis as an `insurance crisis’ – conflating cause with effect. Legislators, spurred by calls from their constituents for lower insurance premiums, often propose measures that would tend to worsen the problem because these proposals generally fail to reflect the importance of accurately valuing risk when pricing coverage.”

California’s Proposition 103 and the federal flood insurance program prior to its Risk Rating 2.0 reforms are just two examples, according to Triple-I.

Learn More:

Triple-I Issues Brief: Wildfire

Triple-I Issues Brief: Risk-Based Pricing of Insurance

How Proposition 103 Worsens Risk Crisis in California

Is California Serious About Wildfire Risk?

Dear California: As You Prep for Wildfire, Don’t Neglect Quake Risk