Legislative reforms put in place in 2022 and early 2023 to address legal system abuse and assignment-of-benefits claim fraud in Florida are beginning to help the state’s property/casualty insurance market recover from its crisis of recent years, according to a new Triple-I Issues Brief.

Claims-related litigation is down, the “depopulation” of the state’s insurer of last resort continues apace, and underwriting profitability – while still in negative territory – has improved significantly. Insurers also benefited from a relatively mild 2023 Atlantic hurricane season and a meaningful increase in investment income, posting a net profit for the first time in seven years.

But it’s important to remember that the crisis wasn’t created overnight and that it will take time for the reforms and other developments to be reflected in policyholder premiums. Homeowners should not expect their rates to decline in 2024, despite the improved industry performance, although some regional insurers have filed for small decreases.

“Rates may moderate some compared to prior years,” said Mark Friedlander, Triple-I director of corporate communications, “but rising replacement costs – combined with expected higher reinsurance costs for the June 1 renewals – are going to continue to drive average premiums upward in 2024.”

One factor keeping upward pressure on rates is fraud and legal system abuse. With only 15 percent of U.S. homeowners insurance claims, the state accounts for nearly 71 percent of the nation’s homeowners claim-related litigation, according to Florida’s Office of Insurance Regulation.

There are early signs that recent legislative reforms are beginning to bear fruit. In 2023, Florida’s defense and cost-containment expense (DCCE) ratio – a key measure of the impact of litigation – fell to 3.1, from 8.4 in 2022, according to S&P Global.

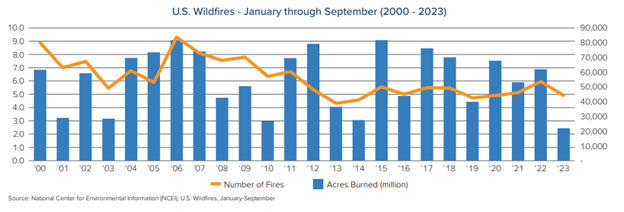

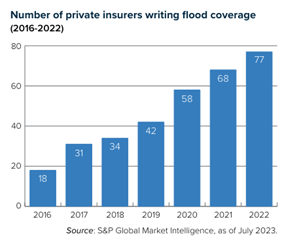

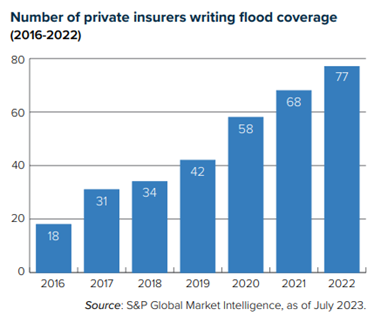

But the catastrophe-prone state faces a number of natural challenges, from a projected “extremely active” 2024 hurricane season to wildfires, flooding, and severe convective storms.

“Hurricanes get the most media attention,” Friedlander said, “but severe convective storms inflict comparable losses. And it only takes one bad hurricane season to wipe out the benefits of one or more mild years.”

Learn More:

2024 Wildfires Expected to Be Up From Last Year, But Still Below Average

CSU Researchers Project “Extremely Active” 2024 Hurricane Season

Lee County, Fla., Towns Could Lose NFIP Flood Insurance Discounts

FEMA Reauthorization Session Highlights Importance of Risk Transfer and Reduction

Triple-I “State of the Risk” Issues Brief: Hurricanes

Triple-I “State of the Risk” Issues Brief: Flood

Triple-I “State of the Risk” Issues Brief: Convective Storms

Triple-I “State of the Risk” Issues Brief: WildfireTriple-I “State of the Risk” Issues Brief: Legal System Abuse