By Lewis Nibbelin, Research Writer, Triple-I

Deadly floods swept through the United States at a record pace in 2025, triggering more flash flood warnings than any year to date. With flood events in 99 percent of U.S. counties over the past 20 years, more communities are vulnerable to flooding than ever before, especially as exposure spreads increasingly inland.

Many homeowners, however, remain unprotected from the risk, underscoring a growing coverage gap as more people move into harm’s way. A new Triple-I Issues Brief explores the insurance industry’s role in closing that gap, as well as the public outreach and mitigation investment needed to reduce losses for all co-beneficiaries of flood resilience.

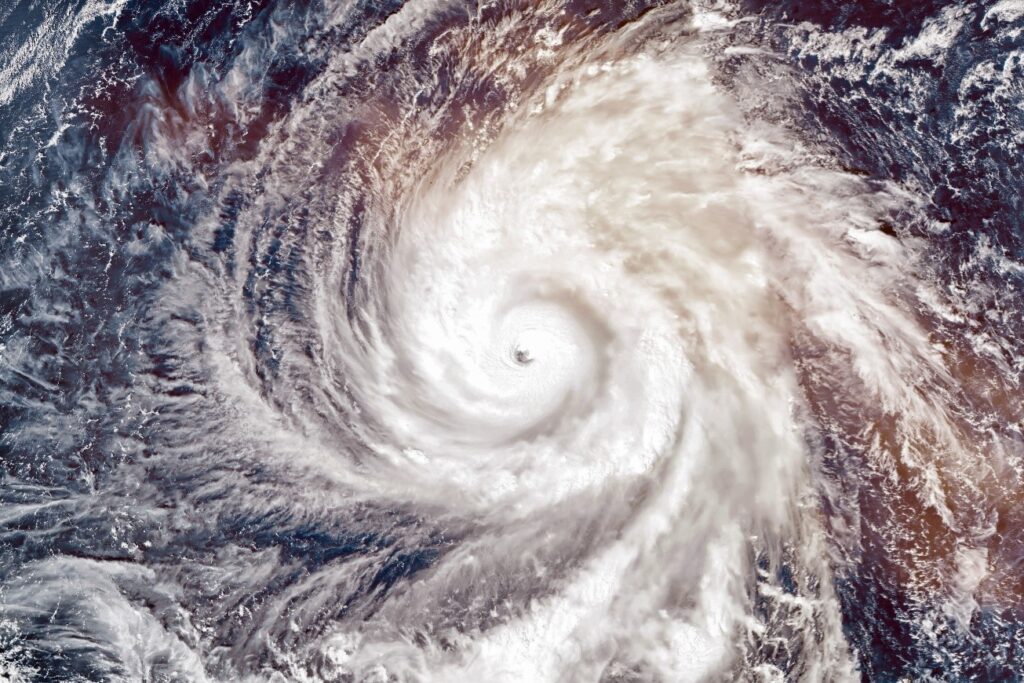

Extreme weather on the rise

Floods – alongside severe convective storms and wildfires – accounted for nearly all insured global losses last year, at $98 billion of $108 billion, according to Munich Re estimates. In the United States, inland flooding from both tropical and severe convective storms caused much of the devastation, led by the unprecedented Central Texas flood that claimed more than 130 lives.

Defined by NOAA as a rapid swing between two extreme environmental conditions, “weather whiplash” is becoming increasingly frequent in states like Texas and California, where prolonged droughts collide with periods of heavy rains and flooding, amplifying their effects. Fueled by increased tropical moisture from higher ocean temperatures, these drought-to-flood/hot-to-cold transitions drove many of the 21 billion-dollar severe convective storms in 2025, more than any prior year on record.

Flood market growth continues

Many homeowners remain unaware that a standard homeowners’ policy doesn’t cover flood damage or believe flood coverage is unnecessary unless their mortgage lender requires it. A separate 2023 study from Munich Re, in collaboration with Triple-I, found 64 percent of homeowners believed they were not at risk for flooding. It also is not uncommon for homeowners to drop flood insurance coverage once their mortgage is paid off to save money.

Though more than half of all homeowners with flood insurance are covered by FEMA’s National Flood Insurance Program (NFIP), federal regulations introduced in 2019 allowed mortgage lenders to accept private flood insurance if policies abided by regulatory definitions, steering a greater percentage of private insurers to the flood market. Between 2016 and 2024, the total flood market grew by nearly 43 percent – from $3.29 billion in direct premiums written to $4.7 billion – with 79 private companies writing just over 27 percent of the business.

Public-private partnerships are crucial

Comprehensive flood protection, however, entails more than adequate coverage. A joint study from the U.S. Chamber of Commerce and Allstate found every dollar invested in disaster resilience can save up to $33 in avoided economic costs down the line. The study emphasized the need for collective action at all levels – individual, commercial, and government – to minimize climate and weather losses.

The NFIP’s Community Rating System (CRS) is one such collaboration, which rewards homeowners with premium discounts of up to 45 percent when their communities invest in floodplain management practices exceeding the organization’s minimum standards. By incentivizing improved building codes, citizen awareness campaigns, and other mitigation initiatives, the CRS can strengthen at-risk areas while offering relief where still needed after the cancellation of programs like FEMA’s Building Resilient Infrastructure and Communities (BRIC).

Learn More:

Climate Nonprofits Take Responsibility for Terminated U.S. Databases

Few, High-Powered Storms Defined 2025 Hurricane Season

Industry, Universities Team Up to Study Convective Storms

End of Federal Shutdown Revives NFIP — For Now

Storms Slam California, Raising Mudslide Risk

Resilience Investment Payoffs Outpace Future Costs More than 30 TimesSome Weather Service Jobs Being Restored; BRIC Still Being Litigated