By Loretta L. Worters, Vice President, Media Relations, Triple-I

Your roof is more than just a covering over your head. It’s the first line of defense against nature’s most powerful forces.

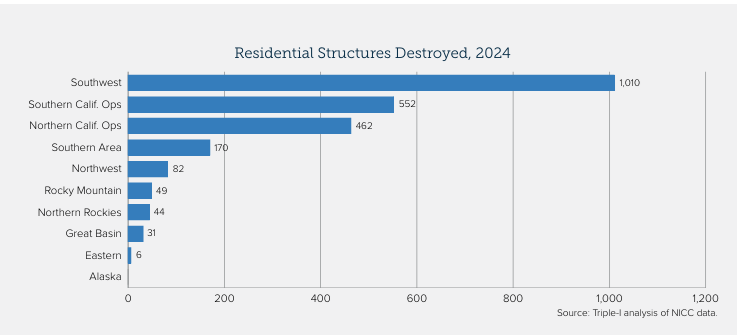

During National Roof Awareness Week (June 1-7), we spotlight the critical role roofs play in protecting homes, businesses, and communities from severe weather (see infographic) and why building stronger, smarter roofs today is essential for reducing damage and insurance claims tomorrow.

Why roof awareness matters

The roof bears the brunt of wind, rain, hail, fire, and flying debris. Yet, many home and business owners overlook its condition until it’s too late. According to the Insurance Institute for Business & Home Safety (IBHS), a staggering 70 to 90 percent of storm-related insurance claims involve roof damage. Whether it’s shingle loss from 60 mph winds or water intrusion through exposed decking, roof failures can turn a storm into a financial disaster.

FORTIFIED: A better way to build and rebuild

Developed by IBHS after decades of research, the FORTIFIED standard is a voluntary construction and re-roofing method that dramatically improves a building’s ability to withstand severe weather. FORTIFIED Roof™ strengthens the most vulnerable parts of a roof, such as edges, decking, and fastening systems, through methods like:

- Using sealed roof decks to prevent water intrusion (can reduce damage by up to 95 percent);

- Requiring ring-shank nails to secure roof decking more effectively; and

- Reinforcing edges with fully adhered starter strips and a wider drip edge.

Many upgrades are affordable. A sealed roof deck can cost as little as $600, and switching to stronger nails might cost under $100 for a typical 2,000-square-foot home. Roofs built to the FORTIFIED standard not only protect what matters most; it can also lead to significant insurance discounts in states like Alabama, Oklahoma, and Mississippi. These programs are making roof resilience accessible and cost-effective for homeowners and businesses alike.

“It only takes one storm to turn a minor vulnerability into major destruction,” said Roy Wright, IBHS president and CEO. “At IBHS, we’ve spent decades studying how buildings fail—and how they survive. That research led to the FORTIFIED Roof standard, a proven way to reduce storm damage. It’s affordable, accessible, and one of the smartest investments a homeowner can make for peace of mind and protection.”

Why It Matters to Insurers

Insurers are increasingly focused on roof resilience because it reduces the number and severity of claims. The FORTIFIED Roof standard is part of a broader industry shift from “detect and repair” to “predict and prevent.”

Poorly maintained or outdated roofs can result in denied claims, higher premiums, or non-renewal of policies. Conversely, resilient roofs may qualify for preferred coverage, lower deductibles, and better insurance options.

“A resilient roof isn’t just a safeguard for a single structure,” said Triple-I CEO Sean Kevelighan. “It’s a smart strategy for reducing risk across entire communities. As frequency and severity of natural disasters rise, insurers are increasingly focused on proactive solutions like the FORTIFIED standard. These improvements help protect property, minimize costly disruptions, and ensure insurance remains available and affordable for more Americans.”

Roofing in wildfire and hurricane zones

Roofs are also vulnerable to wildfire embers, especially in areas where debris can ignite on the roof surface. For wildfire-prone regions, following IBHS’s Wildfire Prepared Home standard and local fire-safe roofing recommendations is critical. Likewise, in hurricane zones, strong connections between roof components can prevent catastrophic failures when wind forces attempt to peel roof decks away.

Replacing or upgrading a roof is one of the most important investments you can make to your property. And thanks to resources like the Roofing Roadmaps from IBHS, homeowners and business owners can make informed decisions about materials, maintenance, and upgrades that will pay off in both resilience and reduced risk.

Learn More:

Study Touts Payoffs From Alabama Wind Resilience Program

FEMA Highlights Role of Modern Roofs in Preventing Hurricane Damage

2025 Tornadoes Highlight Convective Storm Losses

Severe Convective Storm Risks Reshape U.S. Property Insurance Market