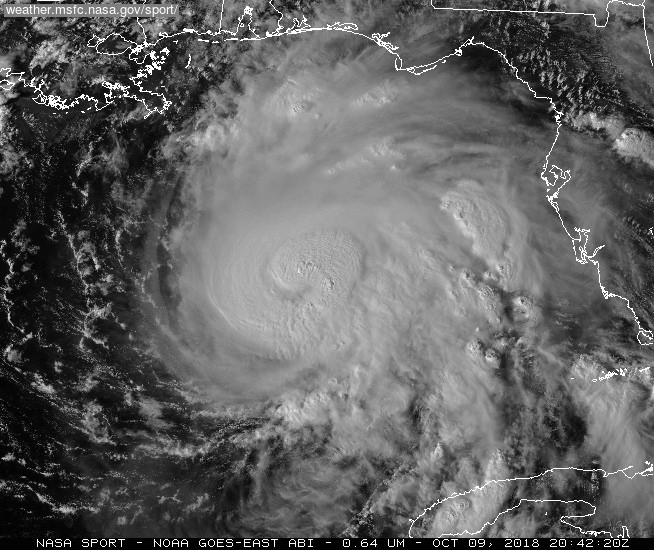

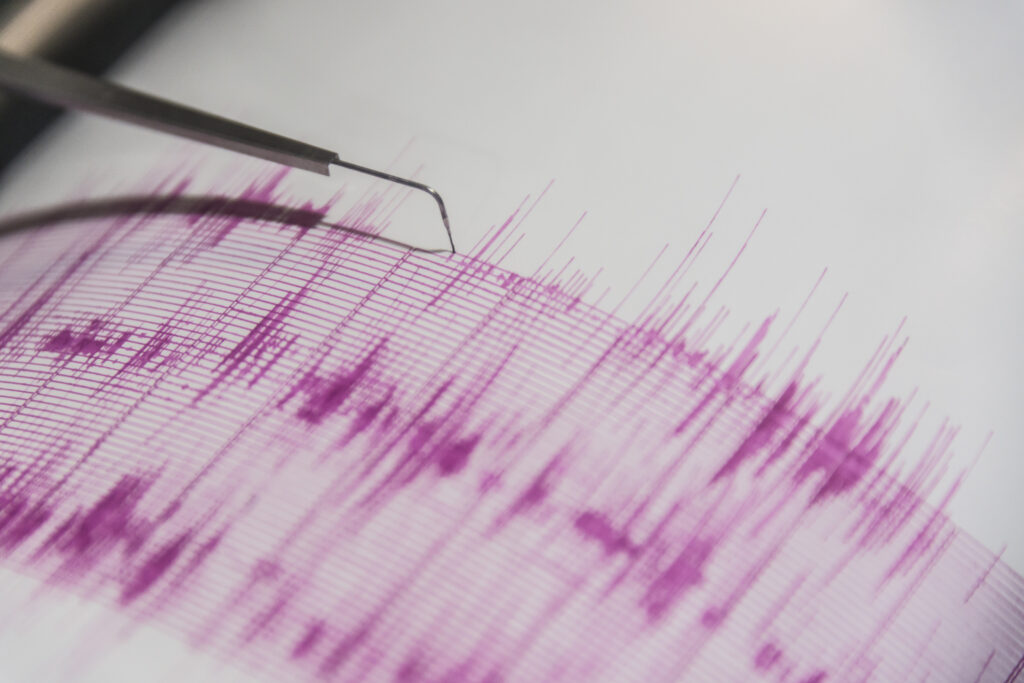

Yesterday’s 8.8 magnitude earthquake near Russia’s Kamchatka Peninsula sent tsunami waves across the Pacific, placing Hawaii under evacuation orders, triggering advisories along the U.S. West Coast, and emphasizing a critical truth about natural catastrophes: They don’t respect borders and tend not to give warnings.

While the immediate impacts were relatively contained—with waves reaching up to 4 meters in Russia’s coastal towns and smaller surges affecting Japan, Hawaii, and Alaska—the event offers a potent and timely reminder about the importance of preparation and investment in resilience.

Coverage Confusion That Could Cost

Standard homeowners insurance policies don’t cover tsunami damage. Neither do earthquake policies, despite the seismic trigger. Tsunami damage falls under flood coverage—a separate policy that many coastal property owners don’t carry.

Flood insurance purchase rates nationally are low – even in coastal communities. This creates a potential perfect storm of financial vulnerability. Communities that experienced evacuation orders yesterday, from Oahu to the Oregon coast might well have been saddled with massive, largely uninsured losses had the tsunami played out differently.

Low Frequency, High Consequence

Tsunami risk represents the most challenging category of natural disasters: extremely rare but potentially catastrophic. Unlike hurricanes or earthquakes that occur with some regularity, major tsunamis affecting U.S. coastlines are generational events. This rarity can breed complacency.

Yesterday’s event, while not causing major damage to U.S. properties, provided invaluable data for catastrophe modelers. The wave propagation patterns, arrival times, and coastal impacts across Hawaii, Alaska, and the West Coast offer fresh insights into how a more severe event might unfold. Insurers and reinsurers are likely already incorporating this data into their risk models.

Building Resilience Through Partnership

The beauty of a “predict and prevent” model of risk management is that it can address a multiplicity of perils. While tsunamis are rare, flooding is not. Recent years have witnessed a rise in inland flooding related to tropical storms, atmospheric rivers, and severe convective storms. The communities affected by catastrophic flood events like the recent ones in Texas and New Mexico and the devastating 2024 floods related to Hurricane Helene tend to have even lower flood insurance “take-up” rates than coastal communities.

The most effective risk management will require unprecedented collaboration between public and private sectors. The NFIP, state insurance departments, and private insurers need to work together on pricing models that accurately reflect risk while remaining accessible to coastal communities. At the same time, communities and businesses must plan and invest together to prepare not just one but many potential climate-related risks.

Learn More:

N.J. Quake a Wake-Up Call for Seismic Mitigation, Resilience Investment

Earthquakes:You Can’t Predict Them, But You Can Prepare

Dear California:As You Prep for Wildfire, Don’t Neglect Quake Risk

JIF 2025: Federal Cuts Imperil Resilience Efforts

BRIC Funding Loss Underscores Need for Collective Action on Climate Resilience

Louisiana Senator Seeks Resumption of Resilience Investment Program

Triple-I Brief Highlights Rising Inland Flood Risk

Hurricane Helene Highlights Inland Flood Protection Gap

Removing Incentives for Development From High-Risk Areas Boosts Flood Resilience

Executive Exchange: Using Advanced Tools to Drill Into Flood Risk

Accurately Writing Flood Coverage Hinges on Diverse Data Sources

Accurately Writing Flood Coverage Hinges on Diverse Data Sources