The Excess and Surplus (E&S) market has grown for five consecutive years by double-digit percentage rates. While expansion appears to have slowed, ample growth likely to continue if major trends persist, according to Triple-I’s latest issue brief, Excess and Surplus: State of the Risk.

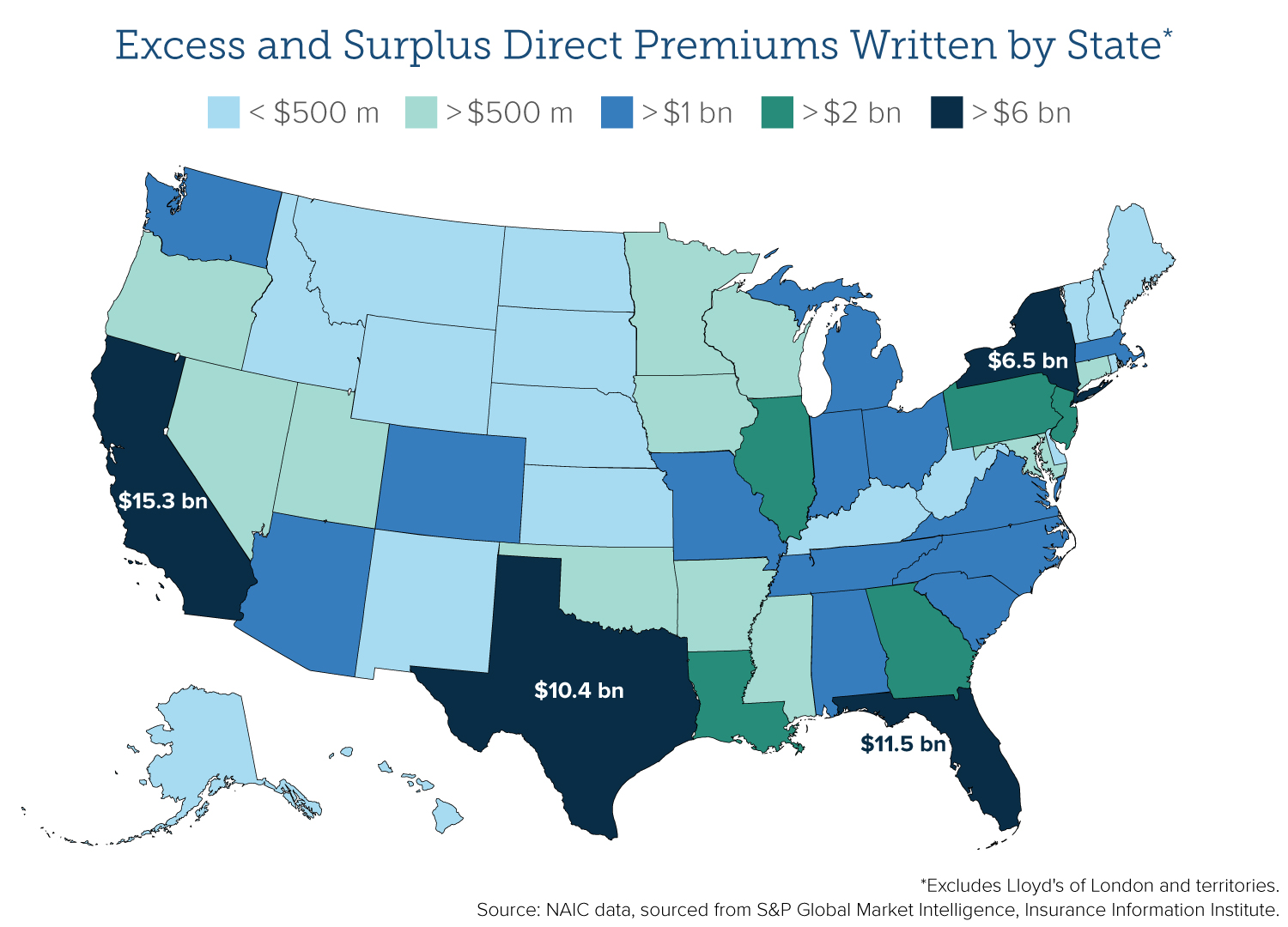

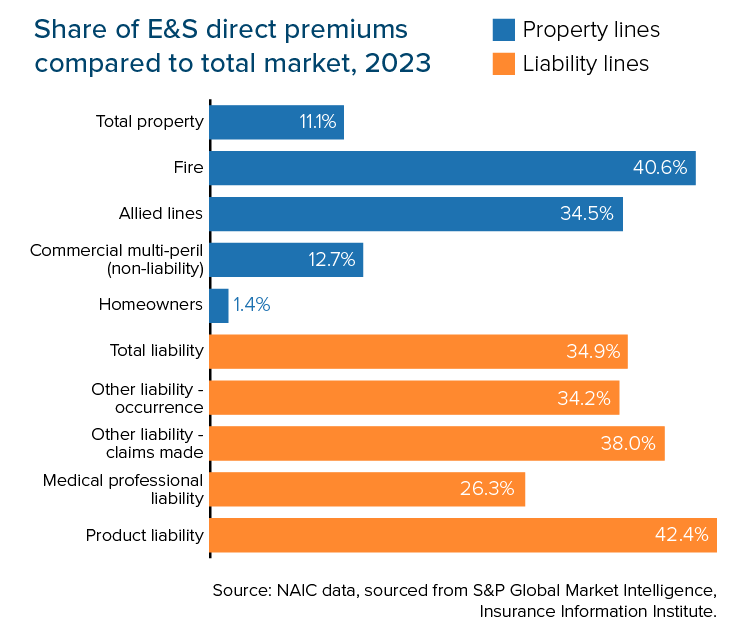

As reported by S&P Global Intelligence, total premiums for 2023 reached $86.47 billion, up from $75.51 billion in 2022. The growth rate for direct premiums in 2023 climbed to 14.5 percent, down from the peak year-over-year (YoY) increase of 32.3 percent in 2021 and 20.1 percent in 2022. The share of U.S. total direct premiums written (DPW) for P/C in 2023 grew to 9.2 percent, up from 5.2 percent in 2013.

The brief summarizes how these outcomes are driven by the niche segment’s capacity to take advantage of coverage gaps in the admitted market and quickly pivot to new product development in the face of emerging or novel risks. Analysis and takeaways, based on data from US-based carriers, highlight dynamics that may support continued market expansion:

- The rising frequency of climate disasters and catastrophes that overwhelm the admitted market

- The increasing number and amount of outsized verdicts (awards over $10 million)

- The sustainability of amenable regulatory frameworks

- Outlook for the reinsurance segment

These factors can also converge to enhance or aggravate conditions.

For example, some states, such as Florida and California, are dealing with significant obstacles to P/C affordability and availability in the admitted market posed by catastrophe and climate risk while also experiencing large respective shares of outsized verdict activity. Also, 13 of the 15 largest U.S. E&S underwriters for commercial auto liability experienced a YoY increase in 2023 direct premiums written. In contrast, eight of the largest 15 underwriters of commercial auto physical damage coverage experienced a decline. Given 2023 research from the Insurance Information Institute showing how inflationary factors from legal costs amplify claim payouts for commercial auto liability, it appears that E&S is flourishing off the struggles of the admitted market.

At the state level, the top three states based on E&S property premiums as portion of the total property market were Louisiana (22.7 percent), Florida (21.1 percent), and South Carolina (19.4 percent) in 2023. The states experiencing the highest growth rates in E&S share of property premiums were South Carolina (9.0 percent), California (8.8 percent), and Louisiana (8.3 percent).

Since the publication of Triple-I’s brief, AM Best released its 2024 Market Segment Report on U.S. Surplus Lines. One of the key updates: after factoring in numbers from regulated alien insurers and Lloyd’s syndicates, the E&S market exceeded the $100 billion premium ceiling for the first time, climbing past $115 billion. The share size in the P/C market has more than tripled, from 3.6 percent total P/C DPW in 2000 to 11.9 percent in 2023. Findings also indicate that DPW is concentrated heavily within the top 25 E&S carriers (ranked by DPW), with about 68% of the total E&S market DPW coming from this group.

The E&S market typically provides coverage across three areas:

- Nonstandard risks: potential liabilities that have unconventional underwriting characteristics

- Unique risks: admitted carriers don’t offer a filed policy form or rate, or there is limited loss history information available

- Capacity risks: the customer to be insured seeks a higher level of coverage than most insurers are willing to provide

Thus, E&S carriers offer coverage for hard-to-place risks, stepping in where admitted carriers are unwilling or unable to tread. It makes sense that the policies typically come with higher premiums, which can boost DPW.

However, the value proposition for E&S policyholders hinges on the lack of coverage in the admitted market and the insurer’s financial stability – especially since state guaranty funds don’t cover E&S policies. Therefore, minimum capitalization requirements tend to higher for E&S than for admitted carriers. Ratings from A&M Best over the past several years indicate that most surplus insurers stand secure. Robust underwriting and strong reinsurance capital positions will play a role in the market’s capacity for continued expansion.

To learn more, read our issue brief and follow our blog for the latest insights.