By Jeff Dunsavage, Senior Research Analyst, Triple-I

I’m pleased and proud to have been part of Triple-I’s Town Hall — “Attacking the Risk Crisis” — in Washington, D.C. In an intimate setting at the Mayflower Hotel on November 30, 120-plus attendees got to hear from experts representing insurance, government, academia, nonprofits, and other stakeholder groups on climate risk, what’s being done to address it, and what remains to be done.

Triple-I’s first-ever Town Hall was designed as a logical step in its multi-disciplinary, action-oriented effort to change behavior to drive resilience. Capping a year in which headlines about “insurance crises” in several states garnered major media attention, Triple-I and its members and partners recognized the need for clarification.

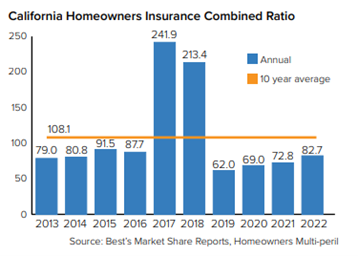

“What we’re seeing is not an ‘insurance crisis’,” Triple-I CEO Sean Kevelighan told the standing-room-only audience. “We’re in the midst of a risk crisis. Rising insurance premium rates and availability difficulties are not the cause but a symptom of this crisis.”

While the insurance industry has a critical role to play and is uniquely well equipped to lead the attack, simply transferring risk is not enough. A recurring theme at the Town Hall was the need to shift from a focus on assessing and repairing damage to one of predicting and preventing losses.

Three moderated discussions – examining the nature of climate risk and its costs; highlighting the need of strategic innovation in mitigating those risks and building resilience; and exploring the role and impact of government policy – gave panelists the opportunity to share their insights with a diverse audience focused on collaborative action.

The agenda was:

Climate Risk Is Spiraling: What Can Be Done?

Moderator: David Wessel, Senior Fellow and Director at the Brookings Institution and former Economics Editor for The Wall Street Journal.

Panelists:

Dr. Philip Klotzbach, Colorado State University, researcher and Triple-I non-resident scholar.

Dan Kaniewski, Managing Director, Public Sector at Marsh McLennan, Former FEMA Deputy Administrator.

Jacqueline Higgins, Head, North America & Senior Vice President, Public Sector Solutions, Swiss Re

Jim Boccher, Chief Development Officer, ServiceMaster.

Jeff Huebner, Chief Risk Officer, CSAA.

Innovation, High- and Low-Tech: How Insurers Are Driving Solutions

Moderator: Jennifer Kyung, VP, Chief Underwriter, USAA.

Panelists:

Partha Srinivasa, EVP, CIO, Erie Insurance.

Sam Krishnamurthy, CTO, Digital Solutions, Crawford.

Bob Marshall, CEO, Whisker Labs.

Stephen DiCenso, Principal,Milliman.

Charlie Sidoti, Executive Director, InnSure.

Outdated Regs to Legal System Abuse: It Will Take Villages to Fix This

Moderator: Zach Warmbrodt, financial services editor, Politico.

Panelists:

Parr Schoolman, SVP and Chief Risk Officer, Allstate.

Tim Judge, SVP, Head Modeler, Chief Climate Officer, Fannie Mae.

Dan Coates, Deputy Director, DRS, Federal Housing Finance Agency.

Fred Karlinsky, Co-Chair of Greenberg Traurig’s Global Insurance Regulatory & Transactions Practice Group.

Panelists and participants alike appreciated the compact, action-focused, conversational nature of the single-afternoon event, as well as the opportunity to discuss areas in which their diverse industry- or sector-specific priorities and efforts overlapped.

If you weren’t able to join us in Washington, don’t worry. In his closing remarks, Kevelighan announced plans to take the program on the road with a local and regional focus, so stay tuned. You can contact us if you’re interested in participating in future Town Halls or other Triple-I events. You also can join the “Attacking the Risk Crisis” LinkedIn Group to be part of the ongoing conversation.